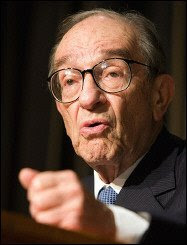

On January 12 of this year, I suggested to Bill Fleckenstein, the author of Greenspan's Bubbles: The Age of Ignorance at the Federal Reserve, that the term most fitting to our present economic era is "The Greenspan Depression."

On January 12 of this year, I suggested to Bill Fleckenstein, the author of Greenspan's Bubbles: The Age of Ignorance at the Federal Reserve, that the term most fitting to our present economic era is "The Greenspan Depression."In his book, Mr. Fleckenstein has established well that Mr. Greenspan conducted Federal Reserve monetary policy by implementing those policies which were most pleasing to his audience - that is, primarily, the now more or less defunct Wall Street money management community and their like-minded brethren around the world.

Low interest rates and easy money guaranteed recurringly high profits for speculators dealing in leverage and risk. When more rope was needed, Mr. Greenspan provided more rope.

No doubt other authorities joined in with Mr. Greenspan in creating an easy money environment as the nation was transformed into a collective of overextended borrowers, flippers and odds-makers, funded by the savings of the much more circumspect but perhaps credulous Asian nations.

No doubt other authorities joined in with Mr. Greenspan in creating an easy money environment as the nation was transformed into a collective of overextended borrowers, flippers and odds-makers, funded by the savings of the much more circumspect but perhaps credulous Asian nations.It is well-known that the SEC pursued short-sellers rather than fraudsters, and that the ratings agencies padded their nests with favourable evaluations of ludicrous ventures.

Is it ALL Mr. Greenspan's fault?

Well, he had many henchmen. But yes, this man is responsible enough. Read Mr. Fleckenstein's book if you don't believe me. I don't mean to exonerate Mr. Bernanke - let's call him Greenspan Junior - but the devastated economic landscape at which Ben is now throwing imaginary money is not of his creation (though as a longstanding Federal Reserve member, he certainly had his part in making it).

Well, he had many henchmen. But yes, this man is responsible enough. Read Mr. Fleckenstein's book if you don't believe me. I don't mean to exonerate Mr. Bernanke - let's call him Greenspan Junior - but the devastated economic landscape at which Ben is now throwing imaginary money is not of his creation (though as a longstanding Federal Reserve member, he certainly had his part in making it).So yes, we are presently living out the Greenspan Depression. I can think of no better term.

How did Mr. Fleckenstein reply to my suggestion?

His words: "I like that... well stated."

Later today, Mr. Fleckenstein commented regarding Mr. Greenspan's role in creating the present (now-deflating) "Ponzi scheme" that has been the US economy since near the outset of his term as Chairman of the Federal Reserve:

Later today, Mr. Fleckenstein commented regarding Mr. Greenspan's role in creating the present (now-deflating) "Ponzi scheme" that has been the US economy since near the outset of his term as Chairman of the Federal Reserve: "The really disturbing part about this disaster that we are all participating in is that none of this had to happen. Had the Federal Reserve in the form of Alan Greenspan not pursued his misguided policies, or stopped them anywhere along the way, none of us would be in this predicament. Obviously there were other indicted and un-indicted co-conspirators, but Greenspan did an immensely disproportionate part of the damage. It is mind-boggling, the havoc that one man could wreak on a country the size of the USA."

"The really disturbing part about this disaster that we are all participating in is that none of this had to happen. Had the Federal Reserve in the form of Alan Greenspan not pursued his misguided policies, or stopped them anywhere along the way, none of us would be in this predicament. Obviously there were other indicted and un-indicted co-conspirators, but Greenspan did an immensely disproportionate part of the damage. It is mind-boggling, the havoc that one man could wreak on a country the size of the USA."For more on the Ponzi scheme that is the US economy, follow this link to "The United Ponzi States of America."

(Carlos Bravo, of the Miami Economy Examiner, used a similar if more complex term on October 4, 2008: "The Great Greenspan Depression of the Millennium." My own use of the term "The Greenspan Depression" does not derive from his work, though I certainly share Mr. Bravo's sentiments. Click here to read his well-considered article.")

(Carlos Bravo, of the Miami Economy Examiner, used a similar if more complex term on October 4, 2008: "The Great Greenspan Depression of the Millennium." My own use of the term "The Greenspan Depression" does not derive from his work, though I certainly share Mr. Bravo's sentiments. Click here to read his well-considered article.")_

No comments:

Post a Comment