The following article was originally published on July 15, 2007, so please read this as a historic document. More recent comments are added at the conclusion of the original post.

The following article was originally published on July 15, 2007, so please read this as a historic document. More recent comments are added at the conclusion of the original post.Jay Taylor has just posted a new inflation-adjusted estimate of gold's peak 1980 price.

As readers of this blog are aware, the price of gold rises in inflationary times.

Readers will also be aware that governments purposely and systematically understate the amount of actual inflation so as to make it possible for debtors everywhere – and governments are the greatest of all debtors – to repay obligations in a devalued currency, thereby enabling the ongoing operations of a debt and liquidity-based economy.

Readers will also be aware that governments purposely and systematically understate the amount of actual inflation so as to make it possible for debtors everywhere – and governments are the greatest of all debtors – to repay obligations in a devalued currency, thereby enabling the ongoing operations of a debt and liquidity-based economy.As a reader, you will also be aware that such an economic strategy punishes savers and rewards debtors by making saving unprofitable, thereby fuelling borrowing, discouraging saving, and creating asset bubbles (government sanctioned Ponzi schemes, if you will).

(Inflating asset bubbles entice citizens who would otherwise be savers to invest their devaluing cash in risky assets, thereby creating economic instability as an inevitable correlate of monetary inflation.)

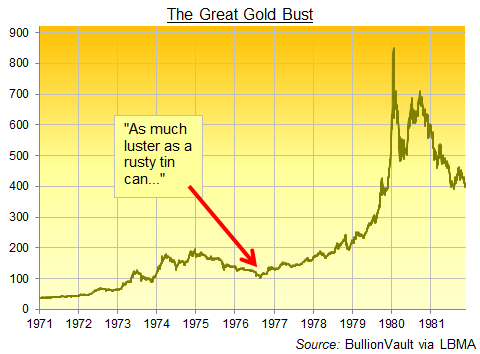

The US government's official figures acknowledge that 1980's peak gold price was not the nominal $887.50 intraday high figure that those of us old enough to remember can recall from that era, but an estimated $1,459.63 US dollars.

Given this figure, we could conservatively expect gold to revisit a price near $1500 per ounce at some point in the upcoming years, based on cyclical fluctuation alone.

However, Mr. Taylor reminds us that the government inflation estimate is in fact grossly understated. According to him, Boston-based money manager Antony Herrey has compiled a chart of the inflation-adjusted gold price using not the government's own CPI statistics, but rather much more accurate inflation numbers compiled by economist John Williams.

Mr. Williams estimates that today’s US inflation rate is closer to 10% than the official (and entirely non-believable) government-reported 2.7%.

Mr. Herrey’s readjustment of the historic gold price based on the actual (non-manipulated, if you will) rate of inflation shows that gold in fact peaked at an inflation-adjusted amount of about $5000 in 1980.

The implication of this recalculation is that by normal cyclical fluctuation alone, it is reasonable to expect the current gold bull market to top out somewhere higher than $5000 per ounce.

Why higher than $5000 per ounce?

Because inflation will continue as the gold price rises.

So at today’s $666.00 per ounce, is gold cheap or expensive?

I think you can figure that one out.

I think you can figure that one out.On my advice, do not invest your devaluing cash in the current stock market and real estate bubbles (or other risky assets) presently exciting North America and much of the developed and developing world, but preserve your savings through the time-honoured store of value offered by precious metals – gold and silver.

Gold is up 150% from its 2001 low. But it can grow a further 750% from today’s levels – in real cash terms – before equalling its inflation-adjusted 1980 peak value.

This dollar-value advance would represent a 2000% or more (non-inflation-adjusted) cash gain from the 2001 low near $250.

Another way to think of it is that in true 1980 dollars, gold’s current market price is not $666.00 per ounce, but a reverse inflation-adjusted $113.00 (1980) US dollars per ounce.

The stock market by and large is trading in bubble territory by historic metrics. Real estate in many North American locations is also in bubble territory. Citizens everywhere are borrowing at a record clip and pouring their savings into ever-riskier assets – with today’s fads being hyper-leveraged hedge funds and the privatization of public companies by pension plans and private equity groups.

The stock market by and large is trading in bubble territory by historic metrics. Real estate in many North American locations is also in bubble territory. Citizens everywhere are borrowing at a record clip and pouring their savings into ever-riskier assets – with today’s fads being hyper-leveraged hedge funds and the privatization of public companies by pension plans and private equity groups.Do not let official government inflation policies force you into risky assets to preserve or increase the value of your savings.

While asset bubbles are over-valued by definition, gold remains radically undervalued, and will be a secure store of wealth for many years to come.

It is not that the price of gold is rising. It is that we are re-evaluating the worth of gold in terms of the declining value of “paper” (or digital) money.

It is not that the price of gold is rising. It is that we are re-evaluating the worth of gold in terms of the declining value of “paper” (or digital) money.Governments around the world can create new money through a series of computer key strokes.

But until the alchemists succeed – or until nuclear fusion advances far beyond today’s levels of sophistication – so that we can create gold at will from “base substances” – gold and silver will remain stores of value that are essentially impervious to the irresponsible inflationary policies of our governments around the world.

But until the alchemists succeed – or until nuclear fusion advances far beyond today’s levels of sophistication – so that we can create gold at will from “base substances” – gold and silver will remain stores of value that are essentially impervious to the irresponsible inflationary policies of our governments around the world.By the way, commodities generally also look very cheap today in inflation-adjusted terms, despite doubling on a broad measure since 2001. The chart below, from Puru Saxena, graphs commodity prices from 1954 through February of this year, with the inflation adjustment based only on the US government's profoundly muted official inflation numbers.

The Reuters/CRB continuous futures commodity index peaked in 1973 at $1048 in nominal "2007 US dollars." If we are to believe John Williams' inflation numbers, the real 1973 commodity index peak would have been in the $3-4000 range in 2007 US dollars. Today's CRB continuous futures index amount – just above $400 – therefore looks very much like a bargain from that perspective – and signals that commodity prices will run much higher before the world's demand for commodities has been sated.

Addendum - 6 & 10 April 2008: This post is the most frequently visited on my site, so I have added links to related information here, where more visitors are likely to find it. Mr Williams has recently updated his inflation-adjusted 1980 gold price to $6030, in order to reflect recent further inflation of the battered US dollar, which, as you know, is unwinding quickly at this time. Click here for more current information.

If you're looking for current gold prices - right up to the minute, visit Kitco.com. Kitco also has a wide selection of historical charts dating back as far as 1792. Kitco also sells gold in various forms, and can hold it for you, with delivery at a later date - allowing multiple purchases over time with only a single delivery charge.

And if it's technical charts you need, go to Stockcharts.com, though these charts date back only to 1990.

For further study of associated underlying factors, such as accumulating debt and escalating money supply, click here.

For more information about Canadian gold investing, click here.

For information about secular trends, click here.

For information on investment issues that relate to gold mining, click here.

For links to precious metal investment advisories, please view my links section to the right.

Could the price of gold rise higher than $6000? Click here for some speculations about a $9000 or higher gold price.

How should gold be priced today? My October 2008 estimate is in the $1600 range. Click here for this article. Bear in mind that "should" and "is" are two different ideas....

13 November 2009: Like the idea of $5000 gold? I'll be honest with you, any estimate of numbers even a few years in the future depends on countless economic unknowables, including the level of fiscal responsibility of all governments around the world (don't get overly optimistic), cumulative global central bank monetary policy, issues of war and peace, free or impeded trade, etc. So who really knows? Not I.

But here is an unlikely person who likes the $5000 number: Martin Armstrong, a financial theorist, former hedge fund manager and convicted Ponzi schemer (see Wikipedia entry here), likes the $5000 number for the year 2016. I can't tell you much about wave theory, not do I have personal knowledge of Mr. Armstrong's character, but I can attest that his fundamental analysis is not entirely off the mark. He states: "Gold has been among the most hated subjects by the socialists, because with each dollar that it advances, it reveals the delusion that they seek to live within."

However, in my view, Mr. Armstrong's critique, with its focus on the shortcomings of socialism, goes nowhere near far enough.

However, in my view, Mr. Armstrong's critique, with its focus on the shortcomings of socialism, goes nowhere near far enough.In correction to Mr. Armstrong, who makes a distinctly partisan argument, let me add that in my view, the fundamental problem is hardly with "the socialists" alone - as this group certainly remain a minority faction in North America and through most of the developed world. Particularly here in North America, it is unlikely that it will be the socialists who do us in....

Basically, every party and faction that seeks to resolve its issues through government rescue of a particular sector of the economy is equally in trouble, and that goes for the belligerent folks at the military-industrial complex, the Wall Street speculators who live for the next government guarantee, policy easing or bailout, the CEOs and executives who award themselves and their cronies obscene salaries and bonuses, the elected representatives who vote themselves comfortable pensions, and the financially reckless at all levels and strata of society from the poorest to the very rich.

Basically, every party and faction that seeks to resolve its issues through government rescue of a particular sector of the economy is equally in trouble, and that goes for the belligerent folks at the military-industrial complex, the Wall Street speculators who live for the next government guarantee, policy easing or bailout, the CEOs and executives who award themselves and their cronies obscene salaries and bonuses, the elected representatives who vote themselves comfortable pensions, and the financially reckless at all levels and strata of society from the poorest to the very rich.Transferring funds from one sector of society to another sector of society through government intervention, exploiting savers and investors to pay off executives and managers, borrowing money we do not have and cannot pay back, billing our present expenses to future generations, and printing money out of thin air, are not sustainable strategies for wealth creation (though all are widely practiced today).

In fact, permit me to restate Mr. Armstrong's words as follows: "Gold has been among the most hated subjects by the financially irresponsible at all levels and in every sector of society, because with each dollar that it advances, it reveals the delusion that they seek to live within."

In fact, permit me to restate Mr. Armstrong's words as follows: "Gold has been among the most hated subjects by the financially irresponsible at all levels and in every sector of society, because with each dollar that it advances, it reveals the delusion that they seek to live within."You heard it here. This is not about socialists. It is about all of us. Let's get our act together and start balancing budgets, promoting savings and investment rather than spending and borrowing, and setting aside reserves for the future rather than bilking our trading partners, shortchanging the purchasers of government bonds, and robbing our children and grandchildren.

I'll say it another way, let's make life easy for savers and investors, and difficult for borrowers and spenders. For a start, let's raise interest rates, not lower interest rates. Rather than taxing those who save, let's subsidize - or at least get out of the way of - private investment in legal and ethical business ventures of all kinds by those who set aside a portion of their funds for other than immediate uses.

That being said, Mr. Armstrong's select monograph on $5000 gold can be found here, courtesy of The Business Insider. Think what you like about his personality or his ethics (I do not condone securities fraud!). But Mr. Armstrong might possibly be on the right side of the trade when it comes to setting future gold price targets.

(More theoretical and critical articles by Mr. Armstrong can be found here.)

18 November 2009: Depending on your preferences, here is another analyst calling for $5000 gold. This time around it's Marc Faber, the Swiss-born trader who has resided in Asia for many years. Mr. Faber is arguing that gold is a better buy now, at over $1100 per ounce, than when it traded at $300 per ounce 6-8 years ago.

Faber states:

Faber states: "I don’t think that you’ll see gold below $1,000 per ounce probably ever again. So I’m quite positive. Maybe, gold at this level is a better buy than it was at $300 per ounce in 2001.

"At first glance, the idea that gold priced at over $1,100 an ounce is 'a better buy' than when the metal traded at about a quarter of that price seems preposterous. But, when you think about it just a little bit (i.e., what constitutes a 'better buy' and how the fundamental factors have now swung so decidedly in gold's favour), maybe it isn't a crazy idea at all.

"I wouldn't be surprised if, in another eight years - in 2017 - the yellow metal fetches $5,000 an ounce or more which, by my math, would make it a better buy. Gold may not rise as much against other currencies, but, after almost a decade of trillion dollar deficits, that almost seems like a slam dunk when the measuring stick is the U.S. dollar."

"I wouldn't be surprised if, in another eight years - in 2017 - the yellow metal fetches $5,000 an ounce or more which, by my math, would make it a better buy. Gold may not rise as much against other currencies, but, after almost a decade of trillion dollar deficits, that almost seems like a slam dunk when the measuring stick is the U.S. dollar."

-----------

Lots of talk right now about longer-term gold targets. Of course, gold can go to infinity if the US dollar loses all of its value. I'm not predicting that, but the losses in the dollar are striking over the scale of the past century (during which the Federal Reserve has had a license to print money).

Dylan Grice, at Societe General, sets a target of $6300 per ounce. I think he is in the ballpark, though his methodology doesn't make sense to me. He is working out how much gold the US has, and what the price of gold would have to be to back every US dollar in existence. Here's the problem - the US government is not going to give anyone gold on demand in exchange for its currency.

Nonetheless, here is Rolfe Winkler's take on Grice's idea.

Nonetheless, here is Rolfe Winkler's take on Grice's idea.

-----------

The $5000 figure is now popular. Martin Hutchinson, a market historian writing at Prudent Bear, observes, "The opportunity for the world's central banks to change policy and affect the economic outcome has been lost. The world economy is now locked on to an undeviating track towards another train wreck."

What is Mr. Hutchinson's gold price target? Again, $5000.

An esteemed historian in his own right, Adrian Ash explains: "Hutchinson sees a repeat of 1978-1980 now unfolding, with the price of gold vaulting to perhaps $5000 an ounce by the end of next year."

An esteemed historian in his own right, Adrian Ash explains: "Hutchinson sees a repeat of 1978-1980 now unfolding, with the price of gold vaulting to perhaps $5000 an ounce by the end of next year."This rate of development of the crisis is a little fast for me....

Mr. Hutchinson sees it like this, however, "If expansionary monetary and fiscal policies are pursued regardless of market signals, the US will head towards Weimar-style trillion-percent inflation... As I said, a train wreck. Probability of arrival: close to 100%. Time of arrival: around the end of 2010, or possibly a bit earlier. And, at this stage, there's very little anyone can do about it; the definitive rise of gold above $1,000 marked the point of no return."

Mr. Ash does not oppose or endorse Mr. Hutchinson's one-year $5000 projection for the gold price, but he concludes, "In short, if you think buying now feels a hard decision, what would you think 50% or 100% higher from here....?"

You know, that's worth thinking about! Click here for Adrian Ash's full article at Seeking Alpha.

18 January 2010: More articles on $5000 gold:

"The Five Reasons Gold Will Hit $5,000"

"Gold May Rise to $5,000 on Inflation, Schroder Says"

"Peter Schiff makes the case for $5000 gold"

"Will Gold Reach $5000 an Ounce?"

"$5,000 Gold?"

"$5,000 Gold In The Future?"

"Could $5,000 gold be too low as dollar loses value?"

"Global Stock Market Forecasts - Shanghai Index 30,000, Gold $5000 and DJIA 17,000"

9 May 2010: Gold's next stop = $3000 per ounce in 2012?

Maybe - click here. (Gold Decouples on International Debt Crisis Concerns - Gold Forecast to Reach $3,000)

Mary Ann and Pamela Aden are also currently considering a 2012 peak target in this range, and suggest that a subsequent peak in 2018-2019 could be several thousand dollars higher.

Enjoy!

13 January 2011: Today is my father's birthday, so I dedicate this post to him.... There is now so much material on this topic, I hardly know where to direct you. But for an overview, one diligent researcher has gone to the trouble of tracking down every known gold price prediction (and here I'm discounting those looking for $680 gold in 2014. That is NOT going to happen through any conceivable course of events - apart from the synthesis of gold in a fusion reactor or the earth's collision with a golden asteroid!).

13 January 2011: Today is my father's birthday, so I dedicate this post to him.... There is now so much material on this topic, I hardly know where to direct you. But for an overview, one diligent researcher has gone to the trouble of tracking down every known gold price prediction (and here I'm discounting those looking for $680 gold in 2014. That is NOT going to happen through any conceivable course of events - apart from the synthesis of gold in a fusion reactor or the earth's collision with a golden asteroid!).Click here for Lorimer Wilson's unique overview: These 110 Analysts Believe Gold Will Go Parabolic to $3,000 or More! (The link may be somewhat circular, as the present article is also mentioned.) Mr. Wilson's article may be of special interest if there are particular analysts that you prefer to follow.

31 January 2011: Here is an up-to-the-minute gold price estimate - following Alan Greenspan's recent recommendation that we reconsider a gold standard. The US gold hoard - the largest in the world - will back the entire US money supply at a rate of $6300 per ounce. It sounds arbitrary, but if the US were to adopt a true gold standard (every dollar in circulation backed by non-printable, non-inflatable physical gold), that's how many dollars is would take to purchase a single ounce of US gold holdings..... Note that Mr Greenspan joins Robert Zoellick of the World Bank, Howard Buffett (but not his son Warren), Jim Grant and Thomas Hoenig of the Kansas City Fed in making this recommendation. Think about it... a gold standard for our ever-inflating money supply, and $6300 gold.

15 February 2011: The current SGS (Shadowstats) inflation-adjusted price for gold's previous 1980 peak value (based on gold's $850 close vs. its $887.50 peak intraday price) is now... get this, $7824 per troy ounce (courtesy of The Dollar Vigilante). And, of course, as inflation increases towards, let us say 2019, we are likely to move above not only an $8000 figure, but quite realistically, a $10,000 figure as well. Caveat: If Ron Paul can tame the Federal Reserve, this could all evolve differently. However, my best guess is that we will require greater crises than we have so far seen (the 2008 crash included) before the populace can be moved towards financial sanity. My prediction - we will require repeated shocks over the better part of the present decade before we come to our senses about money-printing and debt repayment.

15 February 2011: The current SGS (Shadowstats) inflation-adjusted price for gold's previous 1980 peak value (based on gold's $850 close vs. its $887.50 peak intraday price) is now... get this, $7824 per troy ounce (courtesy of The Dollar Vigilante). And, of course, as inflation increases towards, let us say 2019, we are likely to move above not only an $8000 figure, but quite realistically, a $10,000 figure as well. Caveat: If Ron Paul can tame the Federal Reserve, this could all evolve differently. However, my best guess is that we will require greater crises than we have so far seen (the 2008 crash included) before the populace can be moved towards financial sanity. My prediction - we will require repeated shocks over the better part of the present decade before we come to our senses about money-printing and debt repayment.The National Inflation Association has the most extensive collection of charts related to issues of money supply, "real" inflation and debt I have so far found. Click here to view dozens of relevant charts on one page.

15 May 2011: Robin Griffiths of Cazenove, according to Eric King, "one of the oldest financial firms on the planet," is widely believed to be the appointed stockbroker to Her Majesty The Queen.

15 May 2011: Robin Griffiths of Cazenove, according to Eric King, "one of the oldest financial firms on the planet," is widely believed to be the appointed stockbroker to Her Majesty The Queen.Mr Griffiths expectations? He is calling for silver at $450, and gold at $12,000. (I have commented before, at such levels, the real determinant is the degree of "dollar destruction.") Click here for Eric King's summary.

22 April 2012: The presently linked article by Stephen Bogner is truly definitive on the topic of where the gold price has been and where it is going. Mr. Bogner gives full consideration to the SGS inflation estimates, which I have often cited.

22 April 2012: The presently linked article by Stephen Bogner is truly definitive on the topic of where the gold price has been and where it is going. Mr. Bogner gives full consideration to the SGS inflation estimates, which I have often cited. Mr. Bogner believes we are now on the verge of the most significant upward breakout yet in the gold price, and his arguments are compelling. In brief, this is a very important and very recent article. Read "The Gold Megatrend" here.

Mr. Bogner believes we are now on the verge of the most significant upward breakout yet in the gold price, and his arguments are compelling. In brief, this is a very important and very recent article. Read "The Gold Megatrend" here. Note that another year has passed, and we are now looking at a previous inflation-adjusted 1980 high gold price of $9000 per ounce. It seems that the only remaining question is whether we are facing escalating inflation that can be contained by policies similar to those used by Paul Volcker in 1980, or whether we are on the eve of hyperinflation, in which case a $9000 gold price would be meaningless (it would rise much, much higher, but in this case, because of the final destruction of the currency in which it is valued).

Note that another year has passed, and we are now looking at a previous inflation-adjusted 1980 high gold price of $9000 per ounce. It seems that the only remaining question is whether we are facing escalating inflation that can be contained by policies similar to those used by Paul Volcker in 1980, or whether we are on the eve of hyperinflation, in which case a $9000 gold price would be meaningless (it would rise much, much higher, but in this case, because of the final destruction of the currency in which it is valued).20 January 2013: Prediction is a dangerous business in the markets, but it's looking like gold is again heading up strongly in 2013, and with good reason. For your edification, here is a 32-year chart of the gold price, dating back to 1980, the year of the previous intra-day peak of $887.50.

22 February 2013: Here is a brief summary of several advisors who foresee higher gold prices, and their estimates: 8 People Who Predicted That Gold Would Surge To Over $5,000 Per Ounce

Or... $3200 gold in 1-2 years: Major Top In Stocks & Major Bottom In Gold

14 July 2013: Well, my last few predictions on the price of gold have been dramatically wrong. Despite arguably the strongest fundamentals in history, gold has managed to plummet while essentially all the factors that normally tend to lift the price of gold have been advancing steadily. I've been watching the gold market for a decade now. What have I learned? In brief, when the fundamentals are bullish, the following two rules have so far applied: (1) When the price of gold goes down more, it then goes up more. (2) When the price of gold goes down longer, it then goes up longer. Stay tuned for $5000 gold, and higher. When? Don't ask me. I don't know. But nothing has happened to alter my prediction.

18 January 2014: Markets, it is said, "do whatever they want." The same can certainly be asserted for the gold market. In fact, bull markets are the most independent, unpredictable and unruly of all markets, as they have "the wind at their back." Gold has certainly proven this since attaining its millennial high of $1924 USD in September 2011, and its recent low of $1179 USD in June 2013 (which was retested only last month).

It now appears that the recent 2-1/4 year (40%) decline in the gold price has mirrored the 47% plunge in the price of gold between 1974 and 1976 (from $198 to $105.50, during gold's last bull market prior to its current one).

Similarly, I think, to most gold bulls, I had believed that gold's 2007-2008 34% pullback (from $1034 to $681) had constituted the long-predicted "primary correction" (a substantial but time-limited price decline that is exhibited by most bull markets). However, as I have just stated, gold, in a bull market, can do anything it wants. Over the past 28 months, it has provided a distinctive opportunity to its most consistent friends (the majority of them in Asia) to buy more at up to 40% lower prices. Hey... good deal for those of us who are still buying (and yes, I am one of those).

So, where are we now? I have commented many times that short-term predictions are "usually wrong." However, I shall attempt one. There are several good reasons to believe that the primary correction of the present gold bull market has been completed. That doesn't necessarily mean that fireworks lie immediately ahead - a strong advance from here might be "too obvious." But are we again climbing the proverbial wall of worry - and to new highs beyond $1924? I certainly think so.

I commented in the middle of last year (July 2013) that when the gold price has "gone down more" and "gone down longer," it has consistently "gone up more" and "gone up longer." That would certainly imply prices exceeding the $2000 range in the not-too-distant future - that is, over the next 2-3 years, or possibly less. And a decisive break above the September 2011 high would imply an intermediate top equal in magnitude to the previous decline - that is, in the $2700 range. Interestingly, that price point, in turn, would be about halfway to the $5000-6000 level that we have been discussing here for many years, with the wild card of inflation thrown in to make real numbers unpredictable.

Well, I've got time to relax, to sit back, and simply to observe - and wait. Why not? The fundamentals for the gold price are stronger now than they have ever been, and physical demand for gold is already at dramatic new highs. I don't know about you, but I can see which way this one is going.

(Artwork by Brenda Brolly.)

_

whilst a very late reply, i completely agree. gold is vastly undervalued, and the CORRECT high when using John Williams CPI figures, is indeed around US$5000/oz. all the best. the only downside i see to owning gold is the possible confiscation by government, as occurred in the 1930s under FDR.

ReplyDeleteThe prospect of confiscation has occurred to me, as it does to all gold investors - though it is harder to confiscate gold (the ultimate non-virtual investment) in an electronic world. For example, the Streettracks Gold (GLD) index fund holds its bullion in London.

ReplyDeleteHere is the link confirming the storage location of StreetTRACKS Gold Shares' bullion in London:

ReplyDeletehttp://www.streettracksgoldshares.com/us/faq/faqs.php

3. Where is the gold held? Is it safe?

The gold that underlies Gold Shares is held in the form of allocated 400 oz. London Good Delivery Bars in the London vaults of HSBC Bank USA. The safekeeping methods are essentially no different from those that have operated without a problem in the London market for centuries. Those safeguards have stood the test of time for both individuals and institutions (including many governments) that store their gold in London vaults. We have tremendous confidence in the Custodian's efforts to ensure the safety of the Trust's gold bullion.

4. What happens to the gold if there is a terrorist attack and it is stolen or damaged?

Though damage or loss as a result of such events is unlikely, should the gold be destroyed or damaged in a terrorist attack, the Custodian is not liable for any delay in performance or non-performance of any of its obligations under the Custody Agreements. See "Force Majeure" section of the prospectus. Should the gold in the Trust Allocated Account or Trust Unallocated Account be stolen or damaged, the Custodian would only be liable for the market value of the gold held in the Trust Allocated Account or Trust Unallocated Account if it were determined that such loss or damage were the result of negligence, fraud or willful default. These are the legal considerations governing the operations of the Custodian. Actual experience in the aftermath of the terrorist attack that destroyed the World Trade Center in New York was that there was effectively no disruption to the operations of a custodian whose vault was unavailable for months, until it was eventually recovered undamaged. The Custodian was able to carry on more or less normal operations by using gold deposited at other locations, or by borrowing gold in the market, and did not have to default on a single transaction.

I would imagine as this crisis deepens, it will be difficult to ascertain how high gold will go. As the velocity of money is sucked into a black hole at unprecedented speed, gold will be the only money to own.

ReplyDeletehttp://www.squidoo.com/junior-gold-mining-stocks

Interestingly, US money supply growth is presently slowing. However, that is probably evidence of the onset of a recession, as recessions lower the demand for money.

ReplyDeleteInflation is definitely the solution everywhere in the world today, with the possible exceptions of Switzerland and Japan (for two different reasons).

Bull markets tend to surprise on the upside, and I think this gold bull market will be no exception.

By the way, your website is interesting. Quite sophisticated.

I am also a fan of Craig Venter. We often drive by the Venter Institute when in the San Diego area.

Thanks Laurence. Kudos to you too! Join up! The lenses with their movable modules are beautiful to work with and you can - make money blogging by sharing in the ad and Google revenue. Squidoo was created by Seth Godin, considered one of the best blog earners on the net.

ReplyDeleteA lot of gold writers are calling for a $6,000 price. Jim Sinclair has a price of $1650, but that's based on inflation adjusted prices, and of course, the core CPI numbers have been fudged for years, so he and others know that $1650 will be far exceeded.

Another lens you might find interesting is Casino Royale Financial Crisis and Dark Liquidity Pools

Thanks MiaBelleza...

ReplyDeleteYes, I follow Jim Sinclair's work closely, as well as Dan Norcini's daily gold charts and commentary.

I took another look at Squidoo, and it is a great system. For example, I visited your Lamborghini site, which is lots of fun.

Obviously, it has proven to be a dark era for junior gold miners, but in my view, this is a sector that will more than recover, while others are instead watching the Dow and the S&P, which have nowhere to go for years to come!

I see the present situation as attributable to short-term thinking, imprudence, habitual excess and inevitable self-indulgence.

With gold again challenging the $1200 level, it's becoming easier and easier to imagine gold at 4-5 times today's price. Bear in mind that $5000 or $6000 gold will be valued in significantly devalued US dollars. Using Jim Rogers' timeline (for a 17-18 year commodity bull market starting in 2001), then we could reasonably project gold's price to peak in about 2018 or 2019. Based on past precedent, the actual peak level will occur in a bubble environment. But is $1200 gold a bubble? Not even close....

ReplyDeleteIt is increasingly appearing that 2012 will be a critical year for the gold price, and then perhaps 2018 or 2019. Look for gold in the $2-3000 range in 2012, and then for perhaps a final surge somewhere over $5000 by 2018 or 2019 - with the gold price level hinging on the extent of monetary inflation at that point.

ReplyDeleteSecular trend theory posits that the anticipated crisis at the end of decade in 2018-2019 would force retrenchments in the global financial system that might then rationalize the price of gold as the system re-establishes itself on a post-crisis stable footing. That, of course, might follow some kind of international scheme of debt forgiveness and of the institution of austerity measures such as we have not seen in our (baby boomer) lifetimes....

I think from 2008 every year is critical for gold as its prices goes on increasing.

ReplyDeleteprice of gold

Alex, You are correct. 2008 created a new base, and gold's price increase has been steadier (more regular/less volatile) since then. As in May 2010, I am still looking to 2012 as a critical year for the gold bull. In particular, I'm looking for the gold miners to stop lagging! For now, the miners pull back on each new record in the gold price. When that contrary pattern changes, the next stage will be here.

ReplyDeleteGold will continue to be attractive regardless as long as their serious economic problems here and abroad gold will be king. I believe that the root of all evil is inflation. Inflation creates more inequality between the haves and the have nots all the time. It creates envy those who have the money and those that don't. It creates different class structures mostly not for the better. I can think of few if any possitive effects of inflation. But I can think of many negative insidious effects that it has on a society. I don't know what a dollar will buy in twenty or thirty years all I know is that it will buy less how much less who knows.

ReplyDeletePenny, I agree with you on all points. Inflation promotes short-term increases in economic activity through adding to debt, resulting in both obvious and non-obvious negative long-term consequences. At its worst, inflationary policy creates forced redistribution of wealth, a frequent historical cause of war.

ReplyDeleteThanks to the efforts (and repeated warnings) of highly perceptive people like Max Keiser and Jim Willey CB (of goldenjackass.com) we have known for quite sometime that Morgan Stanley is the chief honcho manipulating the Silver market through the misuse of "shorts" and/or "naked shorts". So, as Anonymous #2 correctly pointed out, we all must simply factor in this 'shorting' truth, this reality, whenever we look at the daily (manipulated) Silber prices and vow to take advantage of it.

ReplyDeletePragati: Much of the talk about naked shorts and manipulation is rumour, and obviously, efforts at manipulation have failed, as silver and gold are both at more or less 7 times their 2000 levels, so why worry about it? (Bill Fleckenstein has friends who worked on the Morgan Stanley commodities desk who know nothing of such manipulation.) If gold wants to go higher it will, and it has friends in the east whose appreciation of its value greatly exceeds our own. By one analysis, it's the only store of value that the Chinese can presently hold that is likely to appreciate, thus accounting for China's status as now the world's largest gold market (and growing.....).

ReplyDeleteBrilliant analysis indeed! Thanks a lot for the share.

ReplyDeleteI'm glad the point was mentioned that even if it reached $8,000/oz, it would be a sign that the currency in serious, serious death throes...which means you wouldn't want to sell your gold to hold worthless dollars - dollars that one day people may not even accept as payment. So where do we draw the line? Do we ever sell? Are we so far gone that we should just hold on to our ounces until a new currency develops? Also, if Prechter is right and we are going into a deflation depression, do we sell our gold if it hits $5-8000/oz and then hold onto our cash in an anticipation of a deflationary malaise where cash is king? It is hard to cover all the bases.

ReplyDeleteHi anonymous. Certainly gold will be king if the currency continues devaluing. And contrary to Mr. Prechter, the current dynamics are anything but deflationary. That is, the whole political landscape would have to change before deflation would become a concern. Fact one: How can it with a $16 trillion plus national debt? A devaluing dollar would force default on the national debt (perhaps a realistic scenario at some point, I'll grant you!), which would not do much for future bond sales!

ReplyDeleteJust to be clear, I've stopped publishing articles on gold, as there is nothing more to say. It is unstoppable now. Own gold or gold miners, or silver and silver miners, and sit back, relax and wait. It's inevitable and certain. The move will continue in waves, but the fate of gold is now "sealed," at least for the balance of this decade.

ReplyDeleteThanks for this article dude. I want invest gold, do you have tips for me?

ReplyDeleteHi Harga. It is now very easy to invest in gold. If you want physical gold, you can establish an account at Kitco, gradually build your position while they hold your gold, and take delivery at a future date. I for one don't expect gold to be seized, and certainly, at least for now, you can purchase one of the many ETFs. We finally have Canadian gold ETFs, and these are a great pick for Canadians. I caution against the leveraged ETFs, as they have daily slippage, and will ultimately "melt away." They are good for short-term positions only. I have personally purchased mainly gold royalty companies, miners and explorers. John Doody's Top Ten (www.goldstockanalyst.com) have a proven record of outperformance, and have certainly helped me to weather the multi-year downturn in miners. I view Franco Nevada as the ultimate way to be leveraged to the gold price, though SIlver Wheaton, Royal Gold and Sandstorm Gold are all good choices on the royalty front. As to producers, it is hard to go wrong with Yamana. And for explorers/emerging producers, I continue to see Rubicon as the top pick. Hope this helps.

ReplyDeleteHmmm. I never commented on the fact that gold did not reach the $3000 range in 2012. In fact, its cyclical peak was the $1923 level attained in September 2011. It normally takes over a year for gold to recover from its periodic blow-off highs, so 2012 ended up actually being a weak year. However, that phase of weakness is quickly wrapping up (I think January 4, 2013 saw the last low of the 16-month consolidation).

ReplyDeleteThe broad markets have "forgotten" about gold, as the investment houses have called each new high the "top" since 2001. That is, Wall Street is now expecting years of declines in gold, and are again missing its accumulating relative strength. I don't know if we're going to see the $3000 level in 2013, but I certainly don't rule it out. And hold onto your hats for the end of this decade. The Federal Reserve is now printing $85 billion in new dollars per month, and that is the exact behaviour that drives gold to ongoing highs.

For beginners its so important to know all the strategies of market, to know all kind s of gold investment

ReplyDeleteAt 14:39 hrs MCX GOLDGUINEA January contract was trading at Rs 23912 down Rs 15, or 0.06 percent. The GOLDGUINEA rate touched an intraday high of Rs 23959 and an intraday low of Rs 23887. So far 408 contracts have been traded. GOLDGUINEA prices have moved down Rs 188 or 0.78 percent in the January series so far.

ReplyDeleteCommodity Market Tips