Let's try the "best-case" scenario for where the US economy can go in the next several years.

In our current "Fed-centric" economic environment, our first assumption must be that the Federal Reserve ("the Fed") will be able to keep tapering its purchases of US bonds and mortgage assets with never-before-existing money, and that nothing crashes.

Fed total asset holdings rose from $3 to $4 trillion in 2013. These assets consist of mixed US bonds and mortgage "securities." With tapering, the Fed is now buying $75 billion in new assets per month, down from $85 billion per month last year. So by the end of this year, their holdings will still be close to $5 trillion. In fact, lets say that they decide they can taper another $10-20 billion per month (we're being optimistic here), so maybe in 2015, they're buying $50 billion a month. Even with a good rate of tapering, they're still going to end up holding something in the $7 trillion range in 3-5 years.

So now, think about how that would impact the budget line if the government and mortgage agencies started paying the Fed back (that is, the US government would need to dig into its own or somebody else's pockets to find another $7 trillion, plus accrued interest, in addition to its current expenditures). Note that China holds $1.3 T, Japan $1.2 T, and all foreign nations $5.7 T in US government bonds.) OK. Let's NOT pay the Fed back, then. We can keep rolling that over. The Fed (truly) doesn't care, since they are legally permitted to print Monopoly money whenever they wish to.

Current US GDP is $16 trillion. US total (Federal only) debt is $17.3 T ($54,000 per citizen). The present blended rate of interest is 2.4%, requiring $415 B per year to pay interest on the current debt (and the Fed already returns its portion of interest due). The foreign holders ($5.7 T) obviously want to collect their payments more than does the Fed. Same for the domestic holders. However, the average rate of interest over the past 20 years was 5.7 %, and 30-year treasuries are presently at 3.76% (up from 2.4% in 2012). Remember that operation TWIST transferred as many long-dated assets as possible into the Fed's hands (figure that one out - OK, I'll help you: Fed purchases of 30-year treasuries keep rates lower through artificially-induced "demand" for this expensive-to-repay product).

The US annual deficit is now back to a "low" $680 B (down from $1.1-1.4 T in the preceding 4 years). Increased tax receipts accounted for 79% of the reduction from the previous year's $1.1 T. Though this is "better," this is only temporarily the case (see below). And, no matter how good it gets, the US national debt will still exceed $20 T in a small number of years.

Now, let's apply historically normal 5.7% interest rates to $20 T in debt. Yes, you calculated correctly. The annual debt service reaches $1.14 T. How much does the IRS collect in taxes? The last year for which we have figures is 2012. In that year, tax receipts were $1.1 T. I think you can see where we're going. In a "normal" interest rate scenario, tax receipts will cover interest payments on the national debt and nothing else.

Bear in mind that in our best-case scenario, the annual deficit may continue to fall, though perhaps only for a short time. The Congressional Budget Office projects that the annual deficit will decline into 2015, to under $500 B, but then will start rising again, due to mushrooming entitlement spending - note that no one anywhere denies this. Remember that so long as the government keeps running deficits, the national debt will continue to increase, thereby placing additional pressure on interest payments.

While interest rates may stay artificially low for a while longer, I think the chart below illustrates reasonably well why a return to the 5% range is likely. There are those who think that 2008-2012 was a "double bottom" in these charts. Economists pay A LOT of attention to interest rate trends, as they exert a multifaceted influence on behaviour, including borrowing, spending, investment and, of course, the flow of credit. In particular, when consumers pay higher interest rates on debt, they make fewer purchases.

While interest rates may stay artificially low for a while longer, I think the chart below illustrates reasonably well why a return to the 5% range is likely. There are those who think that 2008-2012 was a "double bottom" in these charts. Economists pay A LOT of attention to interest rate trends, as they exert a multifaceted influence on behaviour, including borrowing, spending, investment and, of course, the flow of credit. In particular, when consumers pay higher interest rates on debt, they make fewer purchases.

Note that 10 and 30-year interest rates are set by the market, NOT by the central planners (foremost among them, the Fed), and that the central planners are presently proposing to intervene somewhat less in "the market." Also consider that real inflation rates are substantially higher than the central planners are telling us (here, take your soma, you'll feel fine). Finally, note that entitlement spending has been "on the rise" for 45 years.

The "conservative" CBO sees future expenses looking like this (they always lowball everything, don't they?):

Note that non-entitlement spending actually has to fall to make the above chart possible.

So at present, we are apparently in what I can only call a transitional period, during which some old ways of picturing our situation (collect taxes, pay bills, run up a tab, keep rates low) will have to give way to some new ways of thinking (OMG, we can't afford this!).

Tipping points are hard to predict in advance. But how can one argue that a tipping point does not lie ahead?

While the bills can obviously be paid with inflated dollars, can this be done without the costs of everything else (including entitlements) also rising?

So, it seems to me a question of "when" vs "if." Have I argued wrongly anywhere?

Remember, I have just described the "best" case for how things can play out.

Because the economy is a complex system, it is difficult to visualize all of its moving parts at one time. It may help to think of it this way. The fundamental problem is very simple: We are spending money we do not have. However, that "game" can play out in many different ways. When we did the same thing in the 1920s, the result was the Great Depression of the 1930s, as the financial dislocations were allowed to work their way through the system, and most of the fundamental problems were eventually corrected by the market itself. That is, the most viable businesses survived, and the economy became more productive and efficient through the process that Joseph Schumpeter called "creative destruction."

Our present generation has been playing more by the rule of "you can have it all." Well, here is how that works. In 2008, a partial withdrawal of financial stimulus by the central planners led to the inability of vulnerable borrowers to make payments on low-quality loans. The infection then spread to middle and upper middle class borrowers as well, and asset values (primarily home prices) collapsed, causing recent home buyers to go "underwater" on their mortgage loans, despite the fact that the loans were originated at very low interest rates. A similar, though more restricted process had occurred in 2000, with the bursting of "the tech bubble" (which was also caused by monetary inflation promulgated by the Fed, but that is not today's topic!).

The Fed responded to the bursting of the housing bubble in late 2007, which led in turn to the financial "crisis" of 2008-2009, with historically-unprecedented measures, including lowering interest rates to well-below the level of inflation, and the initiation of massive purchases of US government bonds and mortgage securities with newly-created money, thereby greatly expanding the total supply of US dollars in circulation, and buoying the faltering (and overbuilt) housing market. The government, for its part, took an ownership stake in badly-run businesses, such as General Motors and Bank of America, preventing them from failing (Lehman Brothers was the canary in the coalmine, and didn't get rescued).

I think what the above discussion illustrates is that it has proven possible to "solve" one problem temporarily by creating another. As a result of spending literally trillions of dollars to bail out mismanaged companies, to restore owners of mispriced homes to solvency, and to keep the economy ticking, the US government chose to take on historically-unprecedented levels of debt, which it has so far been able to manage through its partnership with the Fed, which has kept interest rates extraordinarily low. As a consequence of continued artificially-low interest rates, government debt payments have remained "manageable," despite the explosion of the absolute amount of the national debt. About $8 trillion was added to the national debt in little more than 5 years, between 2008 and 2013, in order to "solve" the problem of the collapse of the housing market together with the consumer economy.

Today, the US stock market is at new highs, and there is universal optimism that the economy is "in recovery," while not so far beneath the surface, the US national government has run up a level of debt never before seen in history, which it has absolutely no means to repay. Concurrently, the US government faces increased entitlement and other expenditures which are expected to "explode" into the far future, beginning in about 2015. A national debt amount of $5.7 trillion on September 30, 2000 has literally tripled to a figure of $17,270,240,354,364.86 today (official figure as of January 16, 2014).

That is, the US presently owes about one-third of all the government debt in the world (total global government debt presently equals $52.5 trillion dollars). As American citizens represent only 4.5% of world population, the average American citizen bears a (government) debt load equivalent to ten times that of remaining global citizens ($53,600 average government debt per US citizen, versus $5,220 average government debt for all other global citizens).

So, in brief, our current "you can have it all" generation has persisted in "solving problems by creating new ones." Rather than face the current financial collapse as we did in the 1930s, by allowing it to run its course, Americans have opted instead to take on unsustainable levels of government debt in order to keep the economy "humming." Of course, the rising debt amounts must either be repaid or inflated away. Neither course is particularly attractive, and both options entail future economic weakness in return for the illusion of economic wellbeing today.

Beneath the surface, the real problem with the current "rescue strategy" of the central planners is that "patchwork" solutions of the type I have described promote what the Austrian economists refer to as "malinvestment." Malinvestment is an almost invisible, but pervasive problem that is only exacerbated by "quick-fix" strategies.

That is, when the economy is merely limping along, wholly dependent on injections of "stimulus" (a euphemism which simply and always means "increased debt"), and with no fundamental factors to justify expectations of real improvement over the long term, business investors simply lack the confidence required to commit their available monies to long-term projects of good quality. They instead divert their investment funds to often-insubstantial, quick-return schemes - for example, the "subprime loan business" of the early 2000s, and the expense reductions, middle-management layoffs and Wall Street game-playing seen everywhere today.

So yes, we can solve one problem by creating another. That is how systems work. But doing this further impairs the functioning of the total system each time that "problem displacement" occurs. So let us now return to our fundamental and very simple problem: spending money we do not have.

How does one actually go about fixing a problem of this kind? The "real fix" for our present predicament is to make the tough decisions about what we must have and what we can do without. My personal belief is that, due to advances in technology and other factors, we truly have the means for all of us to live reasonably well today (though not like kings and queens) if we make some tough decisions.

First among these "tough decisions" is for the people themselves to wake up to the fundamental problem, which is that we can have a good life - caring well for each other, including for the weakest and most vulnerable members of society - but we cannot "have it all."

In my view, there is a lot that we can do without, and I have blogged about this before. I'm confident that we can dispense with our current fixations on the use of police powers and prisons to solve social problems, on military power to solve international problems, on hyper-regulation to limit the "unpredictability" of free markets, and on zero-sum game-playing in many spheres, for example, our current fixation with lawsuits and litigation of all kinds (vs. cooperative problem-solving).

Secondly, all of us, in my opinion, need to engage in much more long-term thinking. We must make some tough collective decisions about the carrying capacity of our planet's natural systems, which are overloaded and failing. We will benefit by making much bigger (not smaller) investments in technologies which promise a better life far into the future, including, in my view, such projects as basic and applied science, education, physical and social infrastructure (including health care and health promotion), fusion energy, robotics, space exploration, etc.

Finally, our political leaders need to have the courage to stand up for long-term versus short-term thinking, and to take the risk of engaging in politically unpopular decisions that hold promise for a truly better future, rather than just muddling through, following rather than leading us, on a day-to-day basis.

Do I have any advice to offer?

Our present generation has been playing more by the rule of "you can have it all." Well, here is how that works. In 2008, a partial withdrawal of financial stimulus by the central planners led to the inability of vulnerable borrowers to make payments on low-quality loans. The infection then spread to middle and upper middle class borrowers as well, and asset values (primarily home prices) collapsed, causing recent home buyers to go "underwater" on their mortgage loans, despite the fact that the loans were originated at very low interest rates. A similar, though more restricted process had occurred in 2000, with the bursting of "the tech bubble" (which was also caused by monetary inflation promulgated by the Fed, but that is not today's topic!).

The Fed responded to the bursting of the housing bubble in late 2007, which led in turn to the financial "crisis" of 2008-2009, with historically-unprecedented measures, including lowering interest rates to well-below the level of inflation, and the initiation of massive purchases of US government bonds and mortgage securities with newly-created money, thereby greatly expanding the total supply of US dollars in circulation, and buoying the faltering (and overbuilt) housing market. The government, for its part, took an ownership stake in badly-run businesses, such as General Motors and Bank of America, preventing them from failing (Lehman Brothers was the canary in the coalmine, and didn't get rescued).

I think what the above discussion illustrates is that it has proven possible to "solve" one problem temporarily by creating another. As a result of spending literally trillions of dollars to bail out mismanaged companies, to restore owners of mispriced homes to solvency, and to keep the economy ticking, the US government chose to take on historically-unprecedented levels of debt, which it has so far been able to manage through its partnership with the Fed, which has kept interest rates extraordinarily low. As a consequence of continued artificially-low interest rates, government debt payments have remained "manageable," despite the explosion of the absolute amount of the national debt. About $8 trillion was added to the national debt in little more than 5 years, between 2008 and 2013, in order to "solve" the problem of the collapse of the housing market together with the consumer economy.

Today, the US stock market is at new highs, and there is universal optimism that the economy is "in recovery," while not so far beneath the surface, the US national government has run up a level of debt never before seen in history, which it has absolutely no means to repay. Concurrently, the US government faces increased entitlement and other expenditures which are expected to "explode" into the far future, beginning in about 2015. A national debt amount of $5.7 trillion on September 30, 2000 has literally tripled to a figure of $17,270,240,354,364.86 today (official figure as of January 16, 2014).

That is, the US presently owes about one-third of all the government debt in the world (total global government debt presently equals $52.5 trillion dollars). As American citizens represent only 4.5% of world population, the average American citizen bears a (government) debt load equivalent to ten times that of remaining global citizens ($53,600 average government debt per US citizen, versus $5,220 average government debt for all other global citizens).

So, in brief, our current "you can have it all" generation has persisted in "solving problems by creating new ones." Rather than face the current financial collapse as we did in the 1930s, by allowing it to run its course, Americans have opted instead to take on unsustainable levels of government debt in order to keep the economy "humming." Of course, the rising debt amounts must either be repaid or inflated away. Neither course is particularly attractive, and both options entail future economic weakness in return for the illusion of economic wellbeing today.

Beneath the surface, the real problem with the current "rescue strategy" of the central planners is that "patchwork" solutions of the type I have described promote what the Austrian economists refer to as "malinvestment." Malinvestment is an almost invisible, but pervasive problem that is only exacerbated by "quick-fix" strategies.

That is, when the economy is merely limping along, wholly dependent on injections of "stimulus" (a euphemism which simply and always means "increased debt"), and with no fundamental factors to justify expectations of real improvement over the long term, business investors simply lack the confidence required to commit their available monies to long-term projects of good quality. They instead divert their investment funds to often-insubstantial, quick-return schemes - for example, the "subprime loan business" of the early 2000s, and the expense reductions, middle-management layoffs and Wall Street game-playing seen everywhere today.

So yes, we can solve one problem by creating another. That is how systems work. But doing this further impairs the functioning of the total system each time that "problem displacement" occurs. So let us now return to our fundamental and very simple problem: spending money we do not have.

How does one actually go about fixing a problem of this kind? The "real fix" for our present predicament is to make the tough decisions about what we must have and what we can do without. My personal belief is that, due to advances in technology and other factors, we truly have the means for all of us to live reasonably well today (though not like kings and queens) if we make some tough decisions.

First among these "tough decisions" is for the people themselves to wake up to the fundamental problem, which is that we can have a good life - caring well for each other, including for the weakest and most vulnerable members of society - but we cannot "have it all."

In my view, there is a lot that we can do without, and I have blogged about this before. I'm confident that we can dispense with our current fixations on the use of police powers and prisons to solve social problems, on military power to solve international problems, on hyper-regulation to limit the "unpredictability" of free markets, and on zero-sum game-playing in many spheres, for example, our current fixation with lawsuits and litigation of all kinds (vs. cooperative problem-solving).

Secondly, all of us, in my opinion, need to engage in much more long-term thinking. We must make some tough collective decisions about the carrying capacity of our planet's natural systems, which are overloaded and failing. We will benefit by making much bigger (not smaller) investments in technologies which promise a better life far into the future, including, in my view, such projects as basic and applied science, education, physical and social infrastructure (including health care and health promotion), fusion energy, robotics, space exploration, etc.

Finally, our political leaders need to have the courage to stand up for long-term versus short-term thinking, and to take the risk of engaging in politically unpopular decisions that hold promise for a truly better future, rather than just muddling through, following rather than leading us, on a day-to-day basis.

Do I have any advice to offer?

A little bit, yes. I'm reasonably confident in stating that over 50% of current government expenditures in most global jurisdictions (not only in the United States) can be classed as "waste." I have blogged about this previously - and I'm not talking about any expenditures that directly help people or which preserve or expand infrastructure or the practice and application of science and "appropriate" technology. We could also spend more profitably in selected areas, first among these, on science education and on basic and applied scientific research (as discussed above).

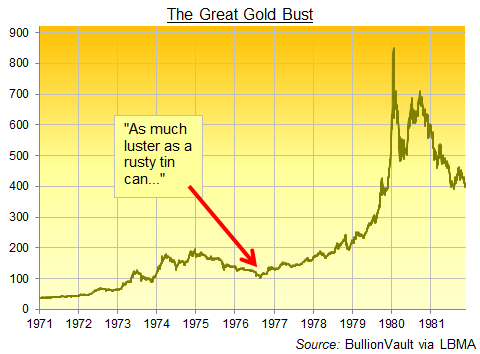

Finally, for investors, history teaches us that in times such as our own - until we "get our act together" and begin to address the fundamental problems we face - gold remains an asset that will preserve value when monetary inflation (a consequence of solving our immediate economic problems by expanding debt) eats away at the market value of virtually everything else. So, yes, keeping your savings in gold or gold-linked assets is still a very, very good idea, in my opinion. I have blogged about this dozens of times, and you may read as little or as much about this as you wish.

If perhaps it seems paradoxical that I am here advocating massively greater societal investments in science and technology, yet advising individuals to invest their personal funds conservatively in gold and gold-linked assets, I can offer an explanation.

As we have been discussing, the present investment climate is not only unsustainable, but precarious. In fact, my real argument in this post has been that we are at present woefully underinvested in such necessary areas as education, social development, and science and technology precisely because we are making very bad social and economic decisions at the systemic level. In such an environment, investments in even the "best" scientific and technological ideas are at risk of failing, due to the absence of a viable and resilient systemic framework to support and sustain them.

That is, we have got to reform our social, political and economic systems so as to make possible an environment in which scientific and technological investments can play out successfully over a longer term. I look forward to the day when I can proclaim that it is finally "safe" to invest in "good ideas." Believe me, this is my ultimate objective.

Precious metal investments are literally a "crisis strategy" for dangerous times, and nothing more than that. Paradoxically, the greater part of the present danger has been created by well-intentioned, academically-sanctioned planners who believe that they can effectively "manage" our problems by centralizing control of the economy, and by riding through every rough patch by taking on more debt.

I hope that what I have shown today is that this type of central planning, with its reflexive reliance upon the accumulation of debt and the suppression of long-term entrepreneurial initiative, rather than being a cure for what ails us, is actually the primary cause of our predicament.

I eagerly await the day when the central planners and debt-advocates will take leave from their posts (in all likelihood, due to the catastrophic failure of their policies - though I emphasize that a voluntary change in direction, or failing that, resignation, would be preferable). At such a time as this, it will then be entirely timely for the rest of us to take action to create - and invest in - a better future for all in a once-again market-driven economy, which, if we choose, can be socially-sensitive as well.

(While I believe that market-driven economies can also be socially-sensitive ones, that, too, is a topic for another day. Centrally-planned economies - including our own at this time, despite their socially-focused ideologies, are typically the least socially-sensitive of all. That is, they are riddled with paradox and counterproductivity because they discount the irreplaceable value of unimpeded choice as exercised by free citizens. If you doubt me on this, please consult the records of Josef Stalin, Robert Mugabe, Hugo Chavez, Osama bin Laden and other well-known central planners. But that is another topic!)

(Artwork by Brenda Brolly.)

18 February 2014: Some thoughts of the day.... Let's try arguing for inflationary policy for a minute. In truth, the $3 trillion (so far) won't have to be paid back. Also, only the Eurozone (including Iceland) is refraining from all-out inflationary policy. That is, everybody else is doing it, too - the Chinese, Japanese, Latin Americans and Africans in spades, for example - even the historically conservative Swiss! Asian manufacturers are keeping costs of goods relatively low, which helps to tame the inflation numbers, though service costs are rising, often dramatically, and the costs to produce anything are going through the roof (mining costs have gone crazy). Analytically, the real problem with inflationary policy (when everybody is doing it) is "malinvestment." That is, the money gets spent differently than when investment is based on savings, and there is no incentive to tame the bureaucracy and the military-industrial and prison-police complexes. So we can "afford" to keep doing all the things we really shouldn't be, including "throwing" money around, over-regulating almost everything, surveilling our citizens and locking a lot of people up for bad reasons. Thus, the problems with inflationary policy aren't obvious, and it looks good on the surface, but it's kind of "rotten" underneath... and that creates low quality new jobs, etc. When you reward savers, you have to stop doing inefficient and counterproductive activities, but the money is spent on long-term projects that are attractive to investors (who are real and usually prudent people), vs get-rich-quick schemes (just look at Wall Street these days, the proliferation of casinos, etc.). Obviously, I have trouble sticking with the pro-inflation side for long, for these reasons!

2 April 2014: Current thinking is that financial tapering can now happen faster, as things still look "OK." My take is that things are not actually OK, when we look beneath the surface. But, let's say tapering happens faster, anyway. The main implication is that the slowdown in money supply expansion then also happens faster. That is, we're slamming harder on the brakes (though bear in mind, we're still "speeding" by a considerable margin). If you look at recent history, the Fed has tried that a few times before, and always with undesired results. And following each intentional slowdown, even more "gas" has been required to get the motor revving again. I'm open to all possibilities, but when I look under the hood, I don't see how you can slow the rate of stimulus and still play the pretend "growth" game. So, let's wait and watch, and see how the fundamentals play out. My guess is that something will happen along the way that will shock the Fed back into "super-easy" policies, as that has been all the speculation-driven markets will accept, really, since 1987....

_

If perhaps it seems paradoxical that I am here advocating massively greater societal investments in science and technology, yet advising individuals to invest their personal funds conservatively in gold and gold-linked assets, I can offer an explanation.

As we have been discussing, the present investment climate is not only unsustainable, but precarious. In fact, my real argument in this post has been that we are at present woefully underinvested in such necessary areas as education, social development, and science and technology precisely because we are making very bad social and economic decisions at the systemic level. In such an environment, investments in even the "best" scientific and technological ideas are at risk of failing, due to the absence of a viable and resilient systemic framework to support and sustain them.

That is, we have got to reform our social, political and economic systems so as to make possible an environment in which scientific and technological investments can play out successfully over a longer term. I look forward to the day when I can proclaim that it is finally "safe" to invest in "good ideas." Believe me, this is my ultimate objective.

Precious metal investments are literally a "crisis strategy" for dangerous times, and nothing more than that. Paradoxically, the greater part of the present danger has been created by well-intentioned, academically-sanctioned planners who believe that they can effectively "manage" our problems by centralizing control of the economy, and by riding through every rough patch by taking on more debt.

I hope that what I have shown today is that this type of central planning, with its reflexive reliance upon the accumulation of debt and the suppression of long-term entrepreneurial initiative, rather than being a cure for what ails us, is actually the primary cause of our predicament.

I eagerly await the day when the central planners and debt-advocates will take leave from their posts (in all likelihood, due to the catastrophic failure of their policies - though I emphasize that a voluntary change in direction, or failing that, resignation, would be preferable). At such a time as this, it will then be entirely timely for the rest of us to take action to create - and invest in - a better future for all in a once-again market-driven economy, which, if we choose, can be socially-sensitive as well.

(While I believe that market-driven economies can also be socially-sensitive ones, that, too, is a topic for another day. Centrally-planned economies - including our own at this time, despite their socially-focused ideologies, are typically the least socially-sensitive of all. That is, they are riddled with paradox and counterproductivity because they discount the irreplaceable value of unimpeded choice as exercised by free citizens. If you doubt me on this, please consult the records of Josef Stalin, Robert Mugabe, Hugo Chavez, Osama bin Laden and other well-known central planners. But that is another topic!)

(Artwork by Brenda Brolly.)

18 February 2014: Some thoughts of the day.... Let's try arguing for inflationary policy for a minute. In truth, the $3 trillion (so far) won't have to be paid back. Also, only the Eurozone (including Iceland) is refraining from all-out inflationary policy. That is, everybody else is doing it, too - the Chinese, Japanese, Latin Americans and Africans in spades, for example - even the historically conservative Swiss! Asian manufacturers are keeping costs of goods relatively low, which helps to tame the inflation numbers, though service costs are rising, often dramatically, and the costs to produce anything are going through the roof (mining costs have gone crazy). Analytically, the real problem with inflationary policy (when everybody is doing it) is "malinvestment." That is, the money gets spent differently than when investment is based on savings, and there is no incentive to tame the bureaucracy and the military-industrial and prison-police complexes. So we can "afford" to keep doing all the things we really shouldn't be, including "throwing" money around, over-regulating almost everything, surveilling our citizens and locking a lot of people up for bad reasons. Thus, the problems with inflationary policy aren't obvious, and it looks good on the surface, but it's kind of "rotten" underneath... and that creates low quality new jobs, etc. When you reward savers, you have to stop doing inefficient and counterproductive activities, but the money is spent on long-term projects that are attractive to investors (who are real and usually prudent people), vs get-rich-quick schemes (just look at Wall Street these days, the proliferation of casinos, etc.). Obviously, I have trouble sticking with the pro-inflation side for long, for these reasons!

2 April 2014: Current thinking is that financial tapering can now happen faster, as things still look "OK." My take is that things are not actually OK, when we look beneath the surface. But, let's say tapering happens faster, anyway. The main implication is that the slowdown in money supply expansion then also happens faster. That is, we're slamming harder on the brakes (though bear in mind, we're still "speeding" by a considerable margin). If you look at recent history, the Fed has tried that a few times before, and always with undesired results. And following each intentional slowdown, even more "gas" has been required to get the motor revving again. I'm open to all possibilities, but when I look under the hood, I don't see how you can slow the rate of stimulus and still play the pretend "growth" game. So, let's wait and watch, and see how the fundamentals play out. My guess is that something will happen along the way that will shock the Fed back into "super-easy" policies, as that has been all the speculation-driven markets will accept, really, since 1987....

_