The absence of Headlines in the US press as gold has surged to record highs over the past few weeks has been both fascinating and disconcerting.

The absence of Headlines in the US press as gold has surged to record highs over the past few weeks has been both fascinating and disconcerting.Record gold prices are clearly a story in commodity and mining-aware Canada. This weekend's headlines include the following Canadian story: "Gold futures surge to record US$900 an ounce on weak dollar, recession fears." The story conservatively estimates gold's previous record high in 1980 at an inflation-adjusted $2200. (It is no secret that a more realistic inflation calculation yields a figure on the order of $5000.)

So, salient though this story may be for Canadians, our American cousins to the south remain concerned, as of this weekend's business headlines, about Fed Chairman Bernanke's next plans to "aid" the economy (in my view, by throwing more gasoline on the fire to keep everyone warm for a little while longer); Mercedes' new SUV (how will gasoline rationing impact the sales and operation of this vehicle?); New York's state probe of Wall Street banks' subprime dealings (blaming the intermediaries and not the principal perpetrators in this top-down process of responsibility-diffusion); the difficulties of steering the Chinese economy (also floating on a sea of excess liquidity); Boeing's new Gulf Air 787 order (the rising jet fuel price is rapidly changing the air travel industry); Northern Rock's new (UK) boss (one of the earlier victims of the debt implosion; the Brits know their economy is in serious trouble, and it is a canary in the coal mine); the rescue of Citigroup by the unlikely duo of China and Prince Alwaleed (pumping yet more foreign currency into US equities to enable the continuation of the liquidity game); Macy's reduction of 271 jobs in the slowing midwest consumer market; Eurozone growth warnings (the problems are mounting in the loosely federated Eurozone); and Wall Street stocks falling as consumers cinch their belts (and we all know that the belt-tightening is only just beginning).

Valid business stories all, but - in my humble opinion - none so important as surging gold, and the changing economic fundamentals which underlie that surge (basically, the decay of all "paper" currencies due to burgeoning central government and central bank fecklessness). Steve Saville has pointed out recently that we prefer to blame the victims of the widening debt implosion for engaging in high risk behaviours that have been blatantly fostered by irresponsible central governments and central banks.

Mr. Saville wisely comments: "The huge quantity of money being recycled by the oil-producing nations and by China is, first and foremost, a symptom of the problem, not a stabilising force. Way too much money has been created over the past ten years and a significant chunk of this new money has ended up with the producers of scarce resources.

Mr. Saville wisely comments: "The huge quantity of money being recycled by the oil-producing nations and by China is, first and foremost, a symptom of the problem, not a stabilising force. Way too much money has been created over the past ten years and a significant chunk of this new money has ended up with the producers of scarce resources."From a short-term perspective it could be considered fortunate that the recipients of the money have turned around and sent it back from whence it came via investments in stocks and bonds, thus preventing some of the bad effects normally associated with high inflation from coming to the surface up until now. However, the fact that some of the traditional effects of rampant money-supply growth -- large increases in bond yields, for example -- were prevented from happening allowed the credit bubble to expand at a much faster pace than would otherwise have been possible. In other words, the so-called 'stabilising force' helped foment a bigger bubble and set the stage for the current debt crisis."

I note also that there has been a very recent upsurge in visits to my blog, an approximate doubling - literally within the past week - as gold has penetrated its former $887.50 nominal peak value. The search terms most often entered enquire why gold surged in 1980, what the inflation-adjusted price of gold was at that time, and why gold is surging now. Hopefully, the entries at this site, as well as the links I have listed (see the right-hand column), will provide visitors with answers to these questions and more.

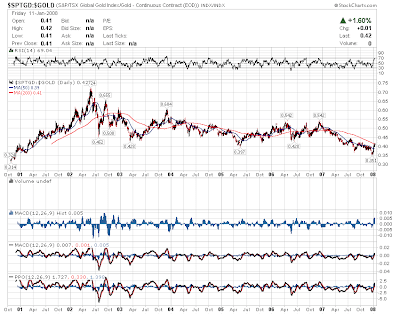

As I have often commented, Canadian gold mining stocks continue to lag the rising commodity qua currency itself, but that pattern could now be changing, as Canadian gold stocks have been stronger than gold (possibly for the frist time since June 2002) during the early days of 2008. I think the Canadian dollar has run its course for now, and so is no longer providing a headwind to stall the movement of Canadian gold stocks.

As I have often commented, Canadian gold mining stocks continue to lag the rising commodity qua currency itself, but that pattern could now be changing, as Canadian gold stocks have been stronger than gold (possibly for the frist time since June 2002) during the early days of 2008. I think the Canadian dollar has run its course for now, and so is no longer providing a headwind to stall the movement of Canadian gold stocks.My perception is that momentum has shifted from the commodity currencies, such as the Canadian Loonie, to the unwinding carry trade currencies - specifically the Japanese Yen and - my favourite - the Swiss Franc. Note that the Swiss Franc is only starting its recovery against the Canadian dollar. And, as the Franc rises in Canadian dollar terms, so too will gold, in my opinion.

If I'm right, then 2008 could be a friendly (if likely volatile) year for Canadian gold mining equity investors - perhaps the friendliest year since 2001 - which is the last time that Canadian gold stocks enjoyed a simple, steady, straightforward upwards climb for a full calendar year. Note that the Canadian gold-stock-to-gold ratio has not been so low since late 2000 - the year the current "stealth" gold bull market began. Canadian gold stocks could ramp a long way upwards from here, and still not be radically overbought against the surging gold price. Look for positive earnings reports from gold miners all year long through 2008....

If I'm right, then 2008 could be a friendly (if likely volatile) year for Canadian gold mining equity investors - perhaps the friendliest year since 2001 - which is the last time that Canadian gold stocks enjoyed a simple, steady, straightforward upwards climb for a full calendar year. Note that the Canadian gold-stock-to-gold ratio has not been so low since late 2000 - the year the current "stealth" gold bull market began. Canadian gold stocks could ramp a long way upwards from here, and still not be radically overbought against the surging gold price. Look for positive earnings reports from gold miners all year long through 2008.... My guess is that the current surge in gold tops out only when it surfaces and plays for a while - for at least a few weeks - in mainstream US headlines (and I don't mean page 13). I never imagined that the gold price story could remain so long submerged in the US business media, but affairs are what they are. It only implies that gold is going higher still.

My guess is that the current surge in gold tops out only when it surfaces and plays for a while - for at least a few weeks - in mainstream US headlines (and I don't mean page 13). I never imagined that the gold price story could remain so long submerged in the US business media, but affairs are what they are. It only implies that gold is going higher still.Dare to imagine, if you will, a world in which Prince Alwaleed and an international consortium had decided to inject $10 billion in gold mining shares rather than the moribund Citigroup. This amount represents only 7% of Citigroup's recently halved - and still highly questionable - market capitalization (it would have constituted only 3.5% less than a year ago).

But $10 billion would buy all of Agnico Eagle Mines, most of Kinross Gold Corporation, almost half of Newmont Mining, or almost one-quarter of recently soaring world leader (and still excessively hedged) Barrick Gold Corporation.

The world I have just asked you to envision is coming, but we are not there yet. And the gold miners will be nowhere near so cheap as they are today when Prince Alwaleed and a coalition of sovereign wealth funds are eventually ready to buy them. (Bill Gates was smart enough to buy into 10% of Pan American Silver at bargain basement prices. Give him credit, he knows more about wise investing than he does about software design!)

The world I have just asked you to envision is coming, but we are not there yet. And the gold miners will be nowhere near so cheap as they are today when Prince Alwaleed and a coalition of sovereign wealth funds are eventually ready to buy them. (Bill Gates was smart enough to buy into 10% of Pan American Silver at bargain basement prices. Give him credit, he knows more about wise investing than he does about software design!) Now let's wait and see how this one develops, but it looks like $900 gold is not yet even a story.

Now let's wait and see how this one develops, but it looks like $900 gold is not yet even a story.Watch the covers of Time Magazine, Newsweek and Fortune (which first featured gold in its January 2006 investor's guide). When you read the story there, again, not at its first surfacing - give it several more weeks or months to run - perhaps then you can collect some profits in return for your due diligence in investing in gold, silver, platinum and precious metal mining shares.

Interesting and understandable.

ReplyDeleteI eagerly await your prophesy coming true.

It will in fact be a wrenching time. But gold is the obvious investment when the primary problem is an economic "multi-bubble." Gold is volatile, but increasingly desirable. Classic real and financial "investable assets" are already riddled with holes, and the case for holding them is simply collapsing.

ReplyDelete