It is no secret to investors that the US 30-year "long" bond has risen in value for 28 years.

It is no secret to investors that the US 30-year "long" bond has risen in value for 28 years.It has certainly also been noticed that this almost one-third century trend has recently reversed - with the reversal confirmed by a break in the long-term-trend-defining 65-week moving average this very week.

The implication is that bond prices could now fall, and interest rates rise, for the next one-third century or so.

The cause, of course, is the massively inflated, bloated, still over-valued US dollar and the floundering US economy.

The rate of change in the bond market is typically glacial, though do remember that even glaciers have periods of rapid movement - when the weather is very cold or very hot.

However, the key point here is that bonds will soon cease to be the outperforming investments that they have been for the past 3 decades. Additionally, it has grown increasingly obvious that general equities are in a long-term bear market.

However, the key point here is that bonds will soon cease to be the outperforming investments that they have been for the past 3 decades. Additionally, it has grown increasingly obvious that general equities are in a long-term bear market.What then will investors turn to for preservation of the value of their holdings?

You know and I know that gold is a store of value in uncertain times.

The reversal in the long-bond trend is a seismic event in the investment world. The tremors will be felt far and wide for decades to come.

The falling bond price is the seismic shift that will ignite the gold tsunami.

The falling bond price is the seismic shift that will ignite the gold tsunami. With both bonds and equities in decline, gold remains the only secure vehicle in the investment world. Other investments may rise, but only gold possesses the combined qualities of relative strength (its time is now) and security (gold is no one else's obligation and thus is not subject to possible default).

With both bonds and equities in decline, gold remains the only secure vehicle in the investment world. Other investments may rise, but only gold possesses the combined qualities of relative strength (its time is now) and security (gold is no one else's obligation and thus is not subject to possible default).Tsunamis begin with a deep undersea earthquake. The disruption in the ocean depths is transmitted to the surface, giving force to the giant waves that later crash to shore at the ocean's perimeter.

The collapse of the 30-year bond price is the earthquake.

The price of gold is the tsunami.

There is a tsunami coming in gold.

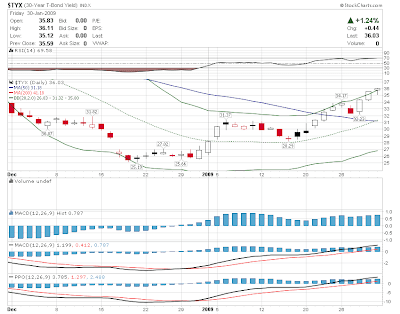

9 August 2009: My charting site allows me to create a chart of the 30-Year Treasury yield from 1990, so let's have a look at that here.

As you can see, the change in trend is most notable on a short-term basis only. The yield bottomed at an amount of 2.519% on Friday, December 19, 2008. This subtle transition can be observed on the following chart.

As you can see, the change in trend is most notable on a short-term basis only. The yield bottomed at an amount of 2.519% on Friday, December 19, 2008. This subtle transition can be observed on the following chart. Though this may look like yet one more dip on a 3-decade journey downwards, don't be deceived. The long-term trend of the 30-year yield is defined by the 65-week (325-day) moving average, and that is the line that was crossed during the first week of May 2009, and again more decisively (after a retest) during the week of May 25-29, 2009.

Though this may look like yet one more dip on a 3-decade journey downwards, don't be deceived. The long-term trend of the 30-year yield is defined by the 65-week (325-day) moving average, and that is the line that was crossed during the first week of May 2009, and again more decisively (after a retest) during the week of May 25-29, 2009. The 65-week moving average has been crossed before, in fact, many times since 1990. But in this case, the rate plunged to an atypical low near 2.5% before almost doubling to 5.066% in June 1990. Each time the 65-week moving average has been violated to the upside, it has appeared that a trend reversal was in the offing.

The 65-week moving average has been crossed before, in fact, many times since 1990. But in this case, the rate plunged to an atypical low near 2.5% before almost doubling to 5.066% in June 1990. Each time the 65-week moving average has been violated to the upside, it has appeared that a trend reversal was in the offing. This time, however, the move appears more definite for several reasons. To begin, this is the first time we've seen a doubling of the yield. Further, the dramatic turnaround of the rate in a "double" in a matter of 6 months is also unprecedented. Given macroeconomic factors, it is also difficult to see how the yield can again fall below 2.5% (a retest of this low in a "double bottom" is certainly possible at some point, particularly if another financial crisis akin to that of 2008 should occur), as foreigners are displaying a markedly diminished appetite for US treasuries, and the US government is running a $2 trillion deficit this year which will not be recouped by increased tax receipts at any foreseeable future time.

This time, however, the move appears more definite for several reasons. To begin, this is the first time we've seen a doubling of the yield. Further, the dramatic turnaround of the rate in a "double" in a matter of 6 months is also unprecedented. Given macroeconomic factors, it is also difficult to see how the yield can again fall below 2.5% (a retest of this low in a "double bottom" is certainly possible at some point, particularly if another financial crisis akin to that of 2008 should occur), as foreigners are displaying a markedly diminished appetite for US treasuries, and the US government is running a $2 trillion deficit this year which will not be recouped by increased tax receipts at any foreseeable future time. If there is an argument against higher long-term rates, it is a weak one based on quantitative easing. This is the practice of the Federal Reserve Bank under Chairman Bernanke to "print money." That is, the Federal Reserve is now creating money "out of thin air" to purchase the 30-year Treasury Bonds that literally no one else wants. While Fed purchases keep the rate artificially low, this is also the same policy followed by such governments as that of Zimbabwe. It is no secret that while the practice may temporarily restrain bond yields, wary investors will be more circumspect about purchasing bonds whose value is being artificially supported by money creation "ex nihilo."

If there is an argument against higher long-term rates, it is a weak one based on quantitative easing. This is the practice of the Federal Reserve Bank under Chairman Bernanke to "print money." That is, the Federal Reserve is now creating money "out of thin air" to purchase the 30-year Treasury Bonds that literally no one else wants. While Fed purchases keep the rate artificially low, this is also the same policy followed by such governments as that of Zimbabwe. It is no secret that while the practice may temporarily restrain bond yields, wary investors will be more circumspect about purchasing bonds whose value is being artificially supported by money creation "ex nihilo."Wikipedia describes the following as the primary risk of quantitative easing:

"Quantitative easing runs the risk of going too far. An increase in money supply to a system has an inflationary effect by diluting the value of a unit of currency. People who have saved money will find it is devalued by inflation; this combined with the associated low interest rates will put people who rely on their savings in difficulty. If devaluation of a currency is seen externally to the country it can affect the international credit rating of the country which in turn can lower the likelihood of foreign investment. Like old-fashioned money printing, Zimbabwe suffered an extreme case of a process that has the same risks as quantitative easing, printing money, making its currency virtually worthless. [13]"

So, yes, quantitative easing may temporarily sustain the market for the now-unloved 30-year US Treasury, but the greater risk is that the US will follow in the footsteps of Weimar Germany, Japan, Argentina (in the past), and most recently Zimbabwe, by "shredding" its currency in the court of international public opinion.

So, yes, quantitative easing may temporarily sustain the market for the now-unloved 30-year US Treasury, but the greater risk is that the US will follow in the footsteps of Weimar Germany, Japan, Argentina (in the past), and most recently Zimbabwe, by "shredding" its currency in the court of international public opinion.For more information on how the Fed carries out quantitative easing, click here, here or here.

So, will quantitative easing support the long-term value of the US 30-Year Treasury Bond?

Unlikely.

The greater chance is that such central bank recklessness will drive international investors to more secure alternatives. For example, the Chinese are now using their stores of foreign capital (mostly US dollars) to stock up on such real-world necessities as copper, as well as to purchase productive assets (mostly commodity-producing investments) around the world.

As you have heard me say before, when paper money is devalued, gold is the historically-favoured alternative place to go to avoid devaluation of your savings. That has not changed in the third millennium.

My gold tsunami posts are as follows:

There Is a Tsunami Coming in Gold

Gold Tsunami II: Anthropomorphizing Gold

Gold: Safe Haven in the Approaching Perfect Storm

Gold Tsunami III: James Kunstler's Use of the Analogy

Bond Prices: The Seismic Shift That Triggers the Gold Tsunami (IV)

Gold Tsunami V: The $23 Trillion Bailout... and Counting

Gold Tsunami VI: Looking for Patterns in Gold Price Advances

Gold Tsunami VII: This Is It

Gold Tsunami VIII: Gold Mining Stocks Now Participating

_

This comment has been removed by a blog administrator.

ReplyDeleteTsunami is an act of nature. No one can control such act but only God. Seismic companies on the other hand can do safety precautions to protect the health of the people concern. The seismic micro can help provide the best survey result to assure the safety of the people and the environment.

ReplyDelete