I enjoy the financial news and analysis site "Seeking Alpha" because the site administrators have no axe to grind. Every view is expressed, and a broad range of contributors are permitted to post articles.

I enjoy the financial news and analysis site "Seeking Alpha" because the site administrators have no axe to grind. Every view is expressed, and a broad range of contributors are permitted to post articles.It is easy to locate others with a view similar to my own at Seeking Alpha, so the kinship of like minds can be found there. However, it is no secret that "too much" like mindedness makes us narrow and cloistered thinkers.

So... I often read articles by (usually intelligent) contributors whose view is entirely different than my own.

Such was the case recently, when I read Eric Steiman's article, "Gold Has Broken Technically and the Selling Will Be Scary."

Such was the case recently, when I read Eric Steiman's article, "Gold Has Broken Technically and the Selling Will Be Scary."Mr. Steiman's main thesis is as follows: "Gold (the author is referring here to the "GLD" exchange traded fund - a tradeable proxy for physical gold) has broken the 50-day moving average and may go all the way to the 200-day (moving average) at 148. I see potential downside of nearly 20%. Making matters worse is that the overall market is taking a major hit. Many investors that have been in the GLD trade will look to sell positions that are in the money or out of the money. You can expect major volatility in the GLD over the coming days, but I think overall it will be much lower in time. The move up was too dramatic, and the fall will be just as bad."

I found Mr. Steiman's arguments parsimonious and reasonable. However, I also disagreed with him.

I found Mr. Steiman's arguments parsimonious and reasonable. However, I also disagreed with him.My reply is presented below, and I will permit my own words to speak for themselves. For more context, please click here for the original article:

Eric,

I think your analysis is smart - you have covered the bases. My critique is that you are using a rear-view mirror. We are not replaying 2008-09 in gold, though we could do so in stocks (the bad news is pointing to recession).

Operation Twist is not inflationary, in that it does not expand the money supply. However, it moves money into the MBS (mortgage-backed security) market, and will presumably stimulate the mortgage refi (refinance) trade. That of course does free up a modest amount of spending money, which will work its way into the consumer markets (at the expense of the banks, who will be collecting lower levels of interest on the refis).

Operation Twist is not inflationary, in that it does not expand the money supply. However, it moves money into the MBS (mortgage-backed security) market, and will presumably stimulate the mortgage refi (refinance) trade. That of course does free up a modest amount of spending money, which will work its way into the consumer markets (at the expense of the banks, who will be collecting lower levels of interest on the refis). However, look at the fundamentals, Eric. Is the collapse of the monetary system as we know it not gold bullish?

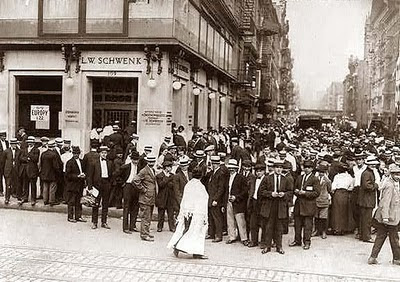

However, look at the fundamentals, Eric. Is the collapse of the monetary system as we know it not gold bullish? Of course, anything can happen short-term, and I understand why pinched investors sell their winners. But then you've gotta think, in a recession, where are your next winners going to come from? Then I'm with most of the crowd that has amassed here.

Of course, anything can happen short-term, and I understand why pinched investors sell their winners. But then you've gotta think, in a recession, where are your next winners going to come from? Then I'm with most of the crowd that has amassed here.If I were to start picking my expected winners for 2012, I'd have to nix general equities, the banking sector, the USD, etc. What is left? Real interest rates will stay low in a recession. And when and where does gold thrive? Right in that sweet spot.

What then is the argument for gold stocks? Try running the CDNX ratio chart over GOLD.

We have already hit the bottom in the small cap miners in gold terms. That implies that the way from here is up. Add to that the new mutual fund buying in the large miners. And where are they going to go in a recession?

We have already hit the bottom in the small cap miners in gold terms. That implies that the way from here is up. Add to that the new mutual fund buying in the large miners. And where are they going to go in a recession?Who is it that has been saying gold stocks will be the next utilities - Jim Sinclair? Yes:

Jim Sinclair "This will result in producing gold mining shares becoming the utilities of 2016 onward."

I think he has got it. With the big miners now paying dividends, and doing fine in terms of revenue and profit growth, and with the Yen, Euro and USD in their death throes... Hey Goldcorp, Yamana and Newmont are now utility stocks!

Last but not least, what technical guy is not going to look for those gaps to be filled in the above charts? October is weak seasonally for gold. A few weeks' of underperformance and base building is reasonable to expect.

Last but not least, what technical guy is not going to look for those gaps to be filled in the above charts? October is weak seasonally for gold. A few weeks' of underperformance and base building is reasonable to expect.But the technical analysis has to be informed by fundamentals.

My fundamental analysis tells me that currency collapses and bank failures are gold bullish - to a very high degree!

My fundamental analysis tells me that currency collapses and bank failures are gold bullish - to a very high degree! _

No comments:

Post a Comment