17 July 2013

The "Coups de Whiskey" of the 1920s and the 2000s

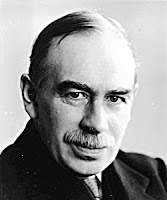

Was J. M. Keynes the Paul Krugman of his era? He was the

first congratulator of the "coup de whiskey."

From Modern Times - The World from the Twenties to the

Eighties, by Paul Johnson:

"Domestically and internationally they constantly

pumped more credit into the system and whenever the economy showed signs of

flagging they increased the dose. The most notorious occasion was in July 1927,

when Strong and Norman held a secret meeting of bankers at the Long Island

estates of Ogden Mills, the US Treasury Under-Secretary, and Mrs. Ruth Pratt,

the Standard Oil heiress. Strong kept Washington in the dark and refused to let

even his most senior colleagues attend, he and Norman decided on another burst

of inflation and the protests of Schacht and of Charles Rist Deputy-Governor of

the Bank of France, were brushed aside.

"Domestically and internationally they constantly

pumped more credit into the system and whenever the economy showed signs of

flagging they increased the dose. The most notorious occasion was in July 1927,

when Strong and Norman held a secret meeting of bankers at the Long Island

estates of Ogden Mills, the US Treasury Under-Secretary, and Mrs. Ruth Pratt,

the Standard Oil heiress. Strong kept Washington in the dark and refused to let

even his most senior colleagues attend, he and Norman decided on another burst

of inflation and the protests of Schacht and of Charles Rist Deputy-Governor of

the Bank of France, were brushed aside.The New York Fed reduced its rate by a further half percent to 3.5; as Strong put it to Rist, 'I will give a little coup de whiskey to the stock-market' -- and as a result set in motion the last culminating wave of speculation. Adolph Miller, a member of the Federal Reserve Board, subsequently described this decision in Senate testimony as 'the greatest and boldest operation ever undertaken by the Federal Reserve System [which] resulted in one of the most costly errors committed by it or any other banking system in the last seventy-five years…

"The policy appeared to be succeeding. In the second

half of the decade, the cheap credit Strong-Normal policy pumped into the world

economy perked up trade...This was genuine economic management at last! Keynes

described 'the successful management of the dollar by the Federal Reserve Board

from 1923-28 as a 'triumph.' Hawtrey's verdict was: 'The American experiment in

stabilization from 1922 to 1928 showed that early treatment could check a

tendency either to inflation or to depression…The American experiment was a

great advance upon the practice of the nineteenth century…Strong's last push,

in fact, did little to help the 'real' economy. It fed speculation. Very little

of the new credit went through to the mass-consumer…

"Strong's coup de whiskey benefited almost solely the

non-wage earners: the last phase of the boom was largely speculative…The 1929

crash exposed in addition the naivety and ignorance of bankers, businessmen,

Wall Street experts, and academic economists high and low; it showed they did

not understand the system they had been so confidently manipulating. They had

tried to substitute their own well-meaning policies for what Adam Smith called

'the invisible hand' of the market and they had wrought disaster. Far from

demonstrating, as Keynes and his school later argued -- at the time Keynes

failed to predict either the crash or the extent and duration of the Depression

-- the dangers of a self-regulating economy, the dégringolade indicated quite

the opposite: the risks of ill-informed meddling."

My comments follow:

Fast forward to today. I believe Mr. Bernanke (our current

Fed Head) to be a noble individual, in that he is the most honest (and

thorough) communicator the Fed has ever had. However, his communications are

quite evidently becoming ever more jumbled, with endless backtracking and

restating. That is, if Mr. Bernanke can't say anything coherent, it's because

the Fed is failing in its (misplaced) mission - which I understand to be

economic central planning.

If there is one thing that should NOT be centrally planned,

it's an economy. It's very difficult to separate economic freedom from

prosperity. And when I talk to all the small business people filling out all

their government paperwork, or observe all the investment managers tuning in to

the next Fed speech, it's pretty clear that our economy is now much less free

than it once was...

For example, the 1950s, when I was growing up, was a quite

free era, despite all the misplaced fears about the doomed system of communism,

with its core mandate for the central planning of "everything."

Surely the advocates of freedom might have recognized that communism would fail

- not because of totalitarianism (which has its own contradictions), but

because of economic central planning.

That is, no "cold war" was ever

needed. Economic central planning always fails. It's just a waiting game.

Unfortunately, today's economic central planners are on our side, and

inevitably, despite the fact that they are not totalitarians, their agenda will also fail, just as did those of Lenin, Stalin,

Mao, Mugabe, Castro, Chavez, the Kim dynasty, John Law, ad infinitum.

_

No comments:

Post a Comment