This is a legacy article, dating back to February 2014. I have been adding updates as they come available. Russian gold reserves have more than doubled since I first published this article, and now stand at fifth in the world.

Here's a strategy I've thought about for a while now. This is only possible because we have abandoned the gold standard (and with it, sound money - you can talk to Ben Bernanke, Janet Yellen and Jay Powell about that --- in fact, to any central bank president almost anywhere in the world --- they are all doing the same thing!).

Let's just say a government decided to print money out of thin air and use it to buy gold. You start with something that is an entirely artificial construct (any national currency in today's world meets this criterion) and use it to buy something that is real, scarce and irreplaceable (gold still meets THOSE criteria!). Voila! You have a "can't-lose" strategy for getting leaps and bounds ahead of everyone else.

Let's just say a government decided to print money out of thin air and use it to buy gold. You start with something that is an entirely artificial construct (any national currency in today's world meets this criterion) and use it to buy something that is real, scarce and irreplaceable (gold still meets THOSE criteria!). Voila! You have a "can't-lose" strategy for getting leaps and bounds ahead of everyone else. And... at least one country is actually doing this. Check out these two Russian charts....

(1) They are buying-up gold hand over fist; and

(2) They are printing money like crazy out of thin air to pay for it (it's virtually without cost for any nation to increase their "money supply" in the same way, but very few are taking advantage of the continuing --- and surprising --- legality of doing this!).

Vladimir Putin is a smart guy, period. Perhaps a few of the rest of us should clue in... and catch up. If only individuals were allowed to print their own currencies, as nation-states do!

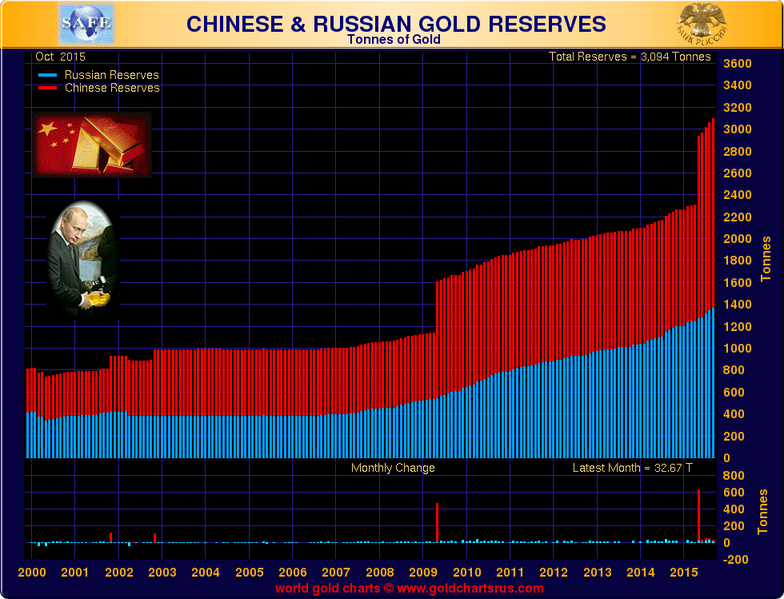

Russia's gold reserves were up 150% in 7 years when I first posted this article:

At the same time, Russia's money supply had increased fully by 33% in only 2 years: more than that of the US, Europe, Japan or China at the time.

Today, in November 2019, Russia's gold holdings are 650% higher than they had been in 2006 (before the bursting of the most recent global financial bubble).

I had argued at the time that rather than bailing out Wall Street and the US government, the Federal Reserve should have just put $10,000 in the mailbox of every US citizen (yes, they actually spent more than that much "new" money to rescue the still-staggering US economy and business elites). This would have done MUCH more for the Main Street economy than bailing out BOTH political parties, GM, Countrywide Financial, Bank of America, AIG Insurance and many other monied interests....

But a better scheme even that that would have been to take the $4 trillion new dollars they had printed to bail out the government and the banks after 2008, and to have quietly, discreetly, and persistently bought gold with it.

Ben Bernanke gave all his money to companies such as Citibank, Fannie Mae, General Motors, and (primarily) the US Treasury, which spent it faster than it came in. It was gone as fast as it was printed, and very little of it actually added to national economic growth.

By way of contrast, Vlad Putin bought gold with his "printed money." That gold is worth much more now than when he bought it, and, keep in mind, he bought it just by rolling his monetary printing presses! In my world, Mr. Putin is BY FAR the wiser --- and smarter --- man.

_

22 August 2014: While some reports show slow periods and even temporary reversals in Russia's accumulation of gold, the most recent figures from the World Gold Council show that Russia has (again) reported an increase in its official reserves since February 2014, moving its place in global national gold rankings up two additional slots. What can I say? Print money, buy gold. It's legal. Just what I don't really get is why only the Russians are doing it.... (Believe me, some day, this will no longer be allowed!)

Russia (#5 globally):

Official gold holdings:

1,094.7 tonnes

Percent of foreign reserves in gold:

9.7%

Russia has increased its gold holding since February 2014 and has eclipsed both Switzerland and China. In August 2014, Russia's central bank decided to buy up even more gold and diversify away from the dollar and the euro as a result of economic sanctions imposed by the West.

Russia's central bank gold holdings crossed the 1,000-tonne mark for the first time in Q3 2013.

Source: World Gold Council

22 December 2014: While I disagree with Mr. Putin on many points, in particular, the suppression of diversity and political and economic freedom at home, the Russians continue to be cleverer than we in many other respects. Despite rumours that they have been selling gold, in fact, it is US dollars that they have been unloading, while (wisely) buying ever more gold.

For more information, click here.

30 January 2015: Russia's gold purchases were up 123% during the first 11 months of 2014, including the period during which the Ruble began to collapse. The Financial Times reports:

"Russia’s central bank purchased 152 tonnes of gold worth $6.1bn at today’s prices, according to GFMS estimates. Analysts also said Russia’s purchases might have been due to the buying of domestically produced gold that could not be easily sold overseas due to sanctions.

“'This is a clear positive for the gold price,' said Matthew Turner, analyst at Macquarie. 'If central banks had not purchased that gold it would have been bought by private investors or jewellery consumers, and this would likely have required a lower gold price.'

"While Russia was a strong buyer this year, analysts say purchases could slow and the country could become a seller if it continues to liquidate its reserves to support the domestic currency."

For the full story, click here.

21 April 2015: Kitco News reports that Russia has resumed gold buying following a 2-month hiatus (click here):

"After a two-month hiatus the Central Bank of the Russian Federation jump back into the gold market, demonstrating that official demand remains strong, say analysts.

"According to media reports, the Russian central bank bought 28 tonnes of gold in March, the biggest one-month purchase since September. In January the central bank sold 0.5 tonnes of gold and didn’t purchase anything in February.

"The report noted, as of April 1, Russia’s official gold reserves stood at 1,128.3 tonnes, compared to the previous level of 1,207.7 tonnes. According to data from the World Gold Council, Russia has the fifth largest gold reserves in the world (not including reserves held by the International Monetary Fund).

2 January 2016, The world's smartest gold buyers have done it again. As of November 2015, we have these figures:

- Russia adds another 700,000 ounces (22 tonnes) to gold reserves in November

- Russian ally Kazakhstan increased gold reserves for 38th month – 7 Mil ounces

- Russia has added 197.1 tonnes in 2015 – Compared with 172 tonnes in all 2014

- November gold buying is Russia’s ninth straight month of increase

- Russia now has sixth largest gold reserves in the world

- Central bank buys all Russian gold production

- Other Russian gold demand imported

- Russia views gold bullion as “100% guarantee from legal and political risks”

Russia continues to add to its gold reserves and added another 700,000 ounces in November or another 22 metric tonnes, and analysts believe this buying will continue and may intensify in the coming months.

Russian ally Kazakhstan increased its gold reserves for a 38th month to 7.03 million ounces in November from 6.96 million ounces a month earlier.

The latest large increase in Russia’s gold reserves – a “buying spree” as reported on Reuters Africa has again gone largely unnoticed by most analysts. Indeed, the important monetary and geopolitical ramifications continue to be largely ignored in western media.

Russia’s total gold reserves have now increased to 44.8 million ounces or around 1,392.8 metric tonnes (up 40% from February 2014, when this article was originally published), with a current value of just $48.3 billion. Russia’s total FX reserves are $371.2 billion and their gold allocation remains just 13% of their total reserves.

The share of gold in Russian foreign exchange reserves is much lower than in many other countries such as the U.S., Italy and France. Russian diversification into gold is likely to continue and could intensify if relations with the U.S. and NATO powers further deteriorate.

Russia still has less than a fifth of the gold reserves of the U.S. which are believed to be over 8,400 metric tonnes of gold. However, the U.S. has no foreign exchange reserves and is the largest debtor in the world – indeed it is one of the largest debtors the world has ever seen.

Russia now has the sixth highest gold reserves in the world – behind the U.S., Germany, Italy, France and China.

In 2014, Russia bought more gold in than in any year since the break-up of the Soviet Union. The country acquired over 173 metric tonnes according to World Gold Council figures. Reserve diversification intensified after April — averaging about 20 tonnes per month....

Meanwhile, Russian money supply has grown another 7% since the end of 2014, an increase of about 2.2 trillion roubles.

22 March 2018. When bars of gold came flying out of a cargo plane taking off from a Siberian airport earlier this month, littering the run-way with precious metal, it was more than symbolic: Russia is hoarding gold, and it’s apparently got so much it can’t keep it contained.

Russia’s been hoarding gold for a while—but it’s going for a new record in 2018, dumping U.S. treasuries for gold at a rate not seen in years as it overtakes China for fifth place among the world’s sovereign holders of the precious metal....

29 July 2018. Russia added 500,000 ounces of gold (15.55174 tons) to reserves in June and bought some 106 tons of gold since the start of the year, with total reserves now approaching the 2,000-metric-ton mark. Last year, Russia added a record 224 tons of gold to the reserves.

Notably, the Bank of Russia has been buying gold every month since March 2015, overtaking China as the fifth-largest sovereign holder of gold. Russia‘s U.S. dollar reserves have also shrunk from $96.1 billion in March to just $14.9 billion in May, according to the Russian Central Bank. Its governor, Elvira Nabiullina, says the decision will help protect the Russian economy and diversify the bank’s reserves.

It's striking that while other central banks have gotten rid of gold and accumulated US dollars, the Russians have been far smarter, getting rid of US dollars and accumulating gold.

22 November 2019. The Russians are beating the western nations at strategy at every turn. Russia added 9.3 metric tonnes of gold to its official reserve position in October. Gold is now 22% of official reserves. The country's total gold reserve is now 2,252 metric tonnes, much less than the U.S., but twice as much as the U.S. holds on a gold-to-GDP basis. Yes, America holds the world's largest store of gold, but that is because of responsible past leadership. The Russians and the Chinese are living in the present, and alert to what is going on now.

Further to Russia's advantage, the US dollar gold price has doubled since 2006.

Buy gold for free, and multiply times two!

_

No comments:

Post a Comment