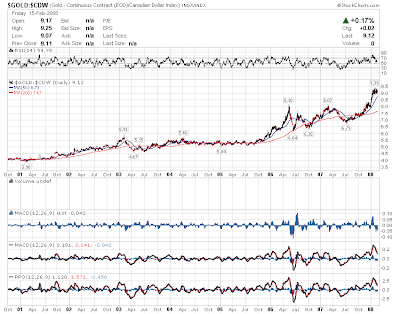

I have been writing for over a year now about the weakness in Canadian gold stocks relative to gold, as signalled by the stalling S&P/TSX Global Gold Index.

This has been a paradox and source of frustration for Canadian gold stock investors, who have seen gold rise steadily (even in Canadian dollar terms) from 2001 through to the present, while Canadian gold stocks relative to the price of gold have fallen steadily since May 2002.

This has been a paradox and source of frustration for Canadian gold stock investors, who have seen gold rise steadily (even in Canadian dollar terms) from 2001 through to the present, while Canadian gold stocks relative to the price of gold have fallen steadily since May 2002.That is, we have now very nearly completed the sixth year in which Canadian gold stocks have dramatically underperformed the commodity that they produce.

What is taking place that can explain this paradoxical trend?

What is taking place that can explain this paradoxical trend?Well, there has been much talk about rising energy and production costs, and of course, the Canadian dollar has risen dramatically during this period, eroding the gains of gold in Canadian dollar terms.

But let me tell you, mining gold, even in Canada, is a more profitable proposition today, at over $900 gold, than it was in May 2002, when gold in Canada sold at $550 per ounce. While the cost of inputs has risen sharply, the ability of Canadians to purchase many of these inputs with appreciating Canadian dollars has risen as well.

Further, Canadian dollar gold was flat from late 2002 through late 2005. However, in the last quarter of 2005, the Canadian dollar price of gold lifted off, and it has not looked back since.

Further, Canadian dollar gold was flat from late 2002 through late 2005. However, in the last quarter of 2005, the Canadian dollar price of gold lifted off, and it has not looked back since.To keep it simple, let me put forward a single alternative idea to explain what might be going on.

The eyes of investors have been fixed for years, if not decades, on fears of economic slowdown or recession, rather than on fears of inflation, which was the bugbear of the 1970s, but which has not “officially” returned since then. (What happened to inflation? Paul Volcker struck it down with high interest rates in the early 1980s, and globalization has kept the prices of finished products low since that time.)

As I have already written, inflation is in fact much higher than acknowledged, but the combined polities of government, banking and investment management have tacitly agreed to ignore inflation by redefining it. Governments have continually massaged cost of living indices to make it appear that inflation has remained under control, though soaring commodity prices have certainly given the lie to this shared pretence. When the costs of food and energy rose too much, they were literally removed from the cost of living indices, rather than acknowledged as signalling the return of the figurative wolf at the door.

Let me suggest that at some point, the eyes of investors must inevitably shift from the fear of recession – which by most measures, now appears to be upon us – to the fear of inflation, which has been an escalating but ignored reality since the beginning of this decade.

Let me suggest that at some point, the eyes of investors must inevitably shift from the fear of recession – which by most measures, now appears to be upon us – to the fear of inflation, which has been an escalating but ignored reality since the beginning of this decade.It is perhaps incredible that our official decision-makers and policy-makers have been able to ignore the reality of inflation for almost the entirety of the present inflation-ravaged decade.

Let me submit to you that the era of the ignorance of inflation is now drawing to a close.

For evidence, let me submit the yield on the 30-year United States Treasury bond, which recorded a multi-decade low at 4.23% only last month. The 30-year bond yield is widely acknowledged as a barometer of inflation expectations.

My suggestion – in an environment of escalating inflation, the so-called “long bond” yield can no longer continue to fall, nor can it remain at today’s record low levels.

Why is that?

Inflation drastically devalues long-term investment products, and there are few investments requiring longer-term commitment than the 30-year bond.

Where then is the yield on the bond headed?

I wish to caution you now – much higher than today’s exceedingly modest levels, and certainly into the double digits as the years unfold.

Is there a “magic number” to watch for?

I can assure you, such knowledge is beyond my ken. But I defer to Pamela and Mary Anne Aden on this point, as they have computed leading indicators and other technical measures which signal a possible reversal in the long bond yield.

The Adens’ calculations result in a figure of 4.78% for the yield on the 30-year US Treasury Bond. A move of the long bond yield above this level, provided rates remain higher than 4.78% going forward, may signal a reversal in the 28-year downtrend that has defined the long bond yield since 1980.

The Adens’ calculations result in a figure of 4.78% for the yield on the 30-year US Treasury Bond. A move of the long bond yield above this level, provided rates remain higher than 4.78% going forward, may signal a reversal in the 28-year downtrend that has defined the long bond yield since 1980.In my view, this reversal, if it occurs in the near future, will signal a very dramatic psychological shift.

For 28 years – almost three decades – investors have concerned themselves primarily with rates of economic growth, and markets have risen and fallen mostly in accord with expectations of accelerating or decelerating economic growth.

I propose that this pattern is now readying itself for a secular (or very long-term) change. Underlying this shift is a continued dramatic increase in monetary inflation, as illustrated by the chart of estimated US "M3" money supply growth below.

Yes, you have read the chart correctly. In four short years, from 2004 through 2008, the number of circulating US dollars has risen from $9 trillion to $13 trillion - almost a 50% increase in a 4-year period - an unimaginable $4 trillion boost in US funds in circulation in little more than the blink of an eye.

Yes, you have read the chart correctly. In four short years, from 2004 through 2008, the number of circulating US dollars has risen from $9 trillion to $13 trillion - almost a 50% increase in a 4-year period - an unimaginable $4 trillion boost in US funds in circulation in little more than the blink of an eye.I submit that for the next 28 years, we are more likely to focus our concern on rising levels of monetary and associated price inflation, a reality which erodes the value of all investments, save one – the price of precious metals, which reliably rise in an inflationary economic environment. (Collectibles in some cases are also a hedge in such conditions.)

Watch the 30-year United States Treasury Bond yield. If it moves and holds above 4.78%, the era of primary concern with economic growth – and recession – has perhaps come to an end.

With this shift in the long bond yield, from reaching a record low only last month to (possibly very soon) grinding relentlessly higher for years to come, another era of concern with rising inflation, and its manifold disruptive economic impacts, will likely begin. (Note that the inverse of the yield, the long bond price, reached a record high of 122.81 in a dramatic island reversal top on January 23, 2008, as recently noted by Clive Maund.)

I submit to you, the era of inflationary concern is with us now, making concerns about both economic growth and recession of secondary importance for years if not decades to come.

I submit to you, the era of inflationary concern is with us now, making concerns about both economic growth and recession of secondary importance for years if not decades to come.Along with this shift, I expect heightened interest in precious metal investing – and correspondingly amplified interest in the mining companies – which, at great cost over many years, and against nearly-insurmountable obstacles, produce the precious metals which represent financial security in an inflationary age.

If I am correct, a reversal in the almost three-decade downtrend in the 30-year US Treasury Bond yield at 4.78% will also signal a shift of focus of investment markets to the precious metals and the precious metal mining companies.

The implication of this shift is that the 6-year drift in the relative value of Canadian precious metal mining companies may also soon be nearing an end. That is, the Canadian precious metal miners may before long be accorded that value they deserve against a background of a long-term “mega” uptrend in the value of the precious metals (specifically gold and silver).

The implication of this shift is that the 6-year drift in the relative value of Canadian precious metal mining companies may also soon be nearing an end. That is, the Canadian precious metal miners may before long be accorded that value they deserve against a background of a long-term “mega” uptrend in the value of the precious metals (specifically gold and silver).Time will of course tell if I am correct in this assertion.

In the interim, I shall proceed to act as though the shifts in trend which I have described here are already in motion.

No comments:

Post a Comment