The excesses of the post-bailout economy are so expansive in scope that little can be done to capture their enormity.

However, courtesy of Clusterstock, here is one chart that does well at capturing our current fundamental picture. Note that the bar chart below is denominated in trillions of US dollars:

Clusterstock provided the following caption in its July 20, 2009 mailing:

Clusterstock provided the following caption in its July 20, 2009 mailing: "TARP watchdog Neil Barofsky says the total size of the bailout has now hit $23.7 trillion, when all the guarantees are factored in. Of course, the government doesn't just provide a bailout total, so different parties may come up with different numbers. But one thing's clear: ever since the first bailout, the estimate has grown and grown and grown and grown and grown. Let's hope today's number is as big as it gets."

"TARP watchdog Neil Barofsky says the total size of the bailout has now hit $23.7 trillion, when all the guarantees are factored in. Of course, the government doesn't just provide a bailout total, so different parties may come up with different numbers. But one thing's clear: ever since the first bailout, the estimate has grown and grown and grown and grown and grown. Let's hope today's number is as big as it gets."Jim Sinclair works this figure out to about $80,000 per American.

This will not be repaid in uninflated dollars.

This will not be repaid in uninflated dollars.When the dollar is devalued, the price of gold rises.

What happens when the value of the dollar collapses?

We will see a tsunami in gold.

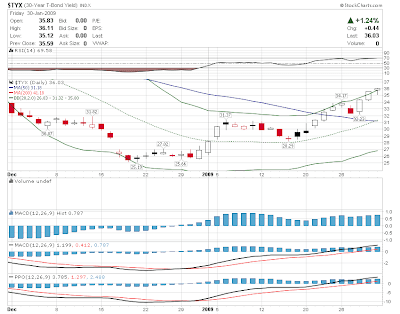

I recently stated that the reversal in the 30-year "long bond" is the seismic event that will trigger the golden tsunami. Of course, the devaluation of the 30-year treasury bond is a consequence of the devaluation of the dollar.

You can't make everybody happy and maintain the value of your currency.

You can't make everybody happy and maintain the value of your currency.Only a government which can say "no" to the majority of its citizens in a time of crisis - particularly to those who are traditionally most influential - can preserve the integrity of the US dollar.

I predict that at some point a government will be elected which is strong enough to say no to those who make unreasonable demands upon the US Treasury.

The present government is not that government.

We are not there yet.

We are not there yet.The necessary national government policy changes will occur post-tsunami.

Man the lifeboats.

Seek the safe haven of the currency that no government can inflate.

Invest in gold now.

My gold tsunami posts are as follows:

My gold tsunami posts are as follows:There Is a Tsunami Coming in Gold

Gold Tsunami II: Anthropomorphizing Gold

Gold: Safe Haven in the Approaching Perfect Storm

Gold Tsunami III: James Kunstler's Use of the Analogy

Bond Prices: The Seismic Shift That Triggers the Gold Tsunami (IV)

Gold Tsunami V: The $23 Trillion Bailout... and Counting

Gold Tsunami VI: Looking for Patterns in Gold Price Advances

Gold Tsunami VII: This Is It

Gold Tsunami VIII: Gold Mining Stocks Now Participating

Blog Entries I Will Never Write:

I've been meaning to write this one for a while.

Have you noticed that Caterpillar is taken seriously when they release their revenue and earnings reports?

Stop and think about it.

Stop and think about it.Caterpillar is a North American vehicle manufacturer. They make Caterpillar equipment here. The company pays competitive wages. They sell their products in a competitive marketplace.

How is that different than GM?

Caterpillar makes money, whereas GM bleeds money.

Caterpillar operates its business without government assistance. GM would have sunk beneath the waves years ago without government bailouts.

Why are taxpayer dollars feeding the bloat at GM (and Chrysler) when we have vehicle makers like Caterpillar onshore?

You want to rescue a North American vehicle manufacturer?

My suggestion - put the taxpayer dollars in Caterpillar, not GM!

My suggestion - put the taxpayer dollars in Caterpillar, not GM!You'll get something back for your investment....

For goodness sake - put your own dollars in Caterpillar. It's a great company - with great products - that is well-run with the intention of making a profit - for shareholders!

For goodness sake - put your own dollars in Caterpillar. It's a great company - with great products - that is well-run with the intention of making a profit - for shareholders!Or in Canada, consider taking shares in Finning at current prices. Price to earnings ratio of about 12:1, and a 3% per year (44 cent) dividend.

Maybe someone at GM should have thought of managing the company for long-term profitability - several decades ago!

Maybe someone at GM should have thought of managing the company for long-term profitability - several decades ago!__